China’s Clean Energy Expansion Stutters as Covid Curbs and High Costs Slow Installations

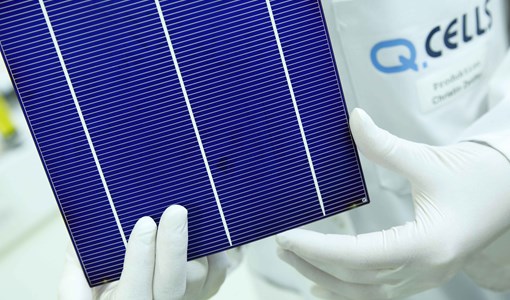

(Bloomberg) -- China’s world-leading ramp-up of clean energy is stuttering as rising costs and Covid restrictions take their toll on the pace of solar and wind installations, heaping pressure on developers to meet their annual targets.

Just 5.6 gigawatts of solar and 1.9 gigawatts of wind capacity were added in October, according to data from the National Energy Administration. Both slowed from September, leaving installations over the year so far at 58 gigawatts for solar and 21 gigawatts for wind, well short of forecasts for 2022 as a whole.

China usually sees a boom in renewable installations toward the end of the year, with December often recording the biggest growth, as developers, especially state-owned ones, rush to hit their annual targets. However, persistent virus curbs and high prices for solar equipment could put the brakes on that effort.

The government hasn’t formally set out the capacity additions it expects for this year, or for the period of the latest five-year plan through 2025, preferring to measure progress via renewables’ share of total energy consumption. But one of the most bullish predictions for 2022 has come from a think tank affiliated with the NEA, which forecast in June that annual installations would reach 100 gigawatts for solar and 56 gigawatts for wind.

Covid Count

China’s Covid count has risen significantly since then. Daily infections are close to the record reached in April, a spike that is testing Beijing’s more targeted approach to containing the virus, and which is likely to worsen with the onset of colder weather. Although the government has avoided the kind of blanket lockdown imposed on Shanghai earlier this year, a total of 48 Chinese cities are now subject to some form of district-level or widespread movement restrictions, according to Nomura Holdings Inc.

One of the biggest developers, China Three Gorges Renewables Group, warned last week that its solar installations will slow. It cited virus disruptions and high costs after a surge in the price of polysilicon drove up panel prices and delayed projects. It also said wind installations had faltered in the first half of the year because of pandemic controls.

Daiwa Capital Markets said the weaker figures for October were disappointing, but reaffirmed its forecast that a record 90 gigawatts of solar and 55 gigawatts of wind would be added in 2022, according to a research note. Tianyi Zhao, an analyst at BloombergNEF, also said she expects over 90 gigawatts of solar, and that the impact of virus restrictions would slowly weaken next year.

State-owned firms will be under political pressure to meet their targets and have a relatively higher tolerance when it comes to investment returns, Zhao said. “If installations can’t meet expectations this year, it will be very difficult for provinces to achieve their installation targets for the 14th five-year plan.”

The Week’s Diary

(All times Beijing unless noted otherwise.)

Wednesday, Nov. 23

- S&P virtual forum on China’s bulk commodities markets, 09:00

- CCTD’s weekly online briefing on the coal market, 15:00

- Cesco Asia Copper Week in Singapore, day 2

Thursday, Nov. 24

- Cesco Asia Copper Week in Singapore, day 3

Friday, Nov. 25

- Guangzhou Futures Exchange hosts forum on silicon futures

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, Nov. 26

- Nothing major scheduled

Sunday, Nov. 27

- China industrial profits for October, 09:30

On The Wire

Europe and the US are becoming much more important drivers of metals demand -- in a tilt away from China -- as the emerging energy transition boosts usage of materials such as copper, according to the chief of commodities trading giant Trafigura Group.

China’s crude buyers have paused purchases of some Russian oil as they wait to see if a US-led cap presents a better price.

The first vessel carrying Brazilian corn to China is set to sail Wednesday after a deal earlier this year between the two nations.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Europe Is Being Scorched and Flooded by Growing Climate Extremes

Apr 22, 2024

Biden Unveils Winners of $2 Billion in Green Tax Credits

Apr 19, 2024

Europe’s Demand for LNG Set to Peak in 2024 as Crisis Fades

Apr 19, 2024

Clean Hydrogen’s Best Bet May Be a Rainforest State in Borneo

Apr 18, 2024

PG&E, Edison, California Apply for $2 Billion US Grid Grant

Apr 18, 2024

China’s Solar Surge Is Making a Missing Power Data Problem Worse

Apr 18, 2024

First Solar Jumps After Report Says Biden to End Trade Loophole

Apr 17, 2024

Biden’s Climate Law Catalyzed Investment, But Projects Still Face Snags

Apr 17, 2024

Masdar and EGA form alliance on aluminium decarbonisation and renewables

Apr 17, 2024

Chevron Launches $500 Million Fund to Invest in Clean Tech

Apr 16, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum