LNG Exports Seen Benefiting From U.S. Credit Bank Financing

(Bloomberg) -- The U.S. Export-Import Bank approved a plan Thursday that could yield a flood of financing for U.S. energy ventures, including wind and solar projects, battery manufacturing and terminals to sell LNG overseas.

The bank’s board voted 3-0 on a formal policy shift encouraged by the Biden administration that would extend support to domestic manufacturing and infrastructure projects that facilitate exports.

Under the program, the bank will provide support across the entire lifecycle of a project, from capital investment to financing meant to secure foreign sales, said Reta Jo Lewis, president of the board of directors.

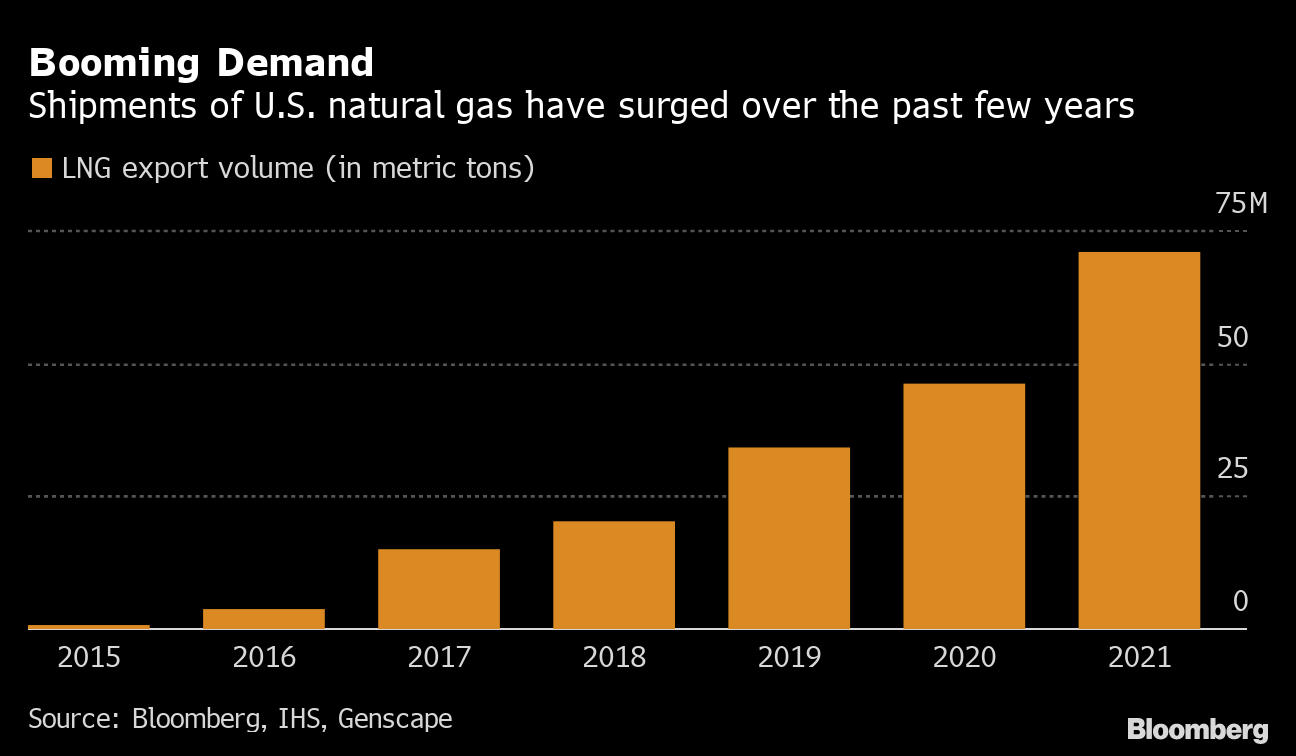

The agency plans to prioritize financing for green projects, from renewable power ventures to clean energy manufacturing. The initiative would apply to non-energy ventures too, including the manufacture of semiconductors, biotech and biomedical gear. Environmentalists and natural gas advocates say the initiative could also bolster a host of LNG export terminals proposed from the U.S. Gulf Coast to Alaska, especially given the Biden administration’s efforts to supplant Russian energy in Europe with U.S. supplies.

Natural gas backers have cheered on the initiative, with the LNG allies arguing that Export-Import Bank financing could help developers seeking to sell their product to countries with fast-growing energy demand but no bankable credit rating.

Projects by Kinder Morgan Inc. and Tellurian Inc. are among those already fully permitted but still await final investment decisions.

Environmental activists warn the move would undermine President Joe Biden’s green goals.

Potential Ex-Im financing for LNG projects “could translate into billions of dollars” in support “and a catastrophic amount of U.S.-financed greenhouse gas emissions,” Friends of the Earth told the agency.

“It would be a climate disaster,” said Kate DeAngelis, the group’s international finance program manager. “These LNG export terminals would be in place for decades.”

An Ex-Im Bank spokesman said any application the agency receives under the new initiative would be subject to existing environmental and social impact reviews. Legally, the agency is barred from discriminating against application based on sector, including liquefied natural gas, the spokesman said.

To qualify for support, projects generally would need to have a significant export nexus, such as by exporting 25% of their production. That threshold would be lowered to 15% for priority projects including “climate-related transactions,” the agency said on their website.

(Adds information about priority export projects in last paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Malibu Firefighters Make Gains on Blaze as Wind Warnings Persist

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters