Oil Holds Near Highest Since November as OPEC+ Tightens Market

(Bloomberg) -- Oil steadied near its highest level since November in a thin holiday trading session as traders await production updates from OPEC+.

West Texas Intermediate futures were little changed above $85 a barrel. The Brent benchmark settled at $89, with both contracts trading in a narrow daily range.

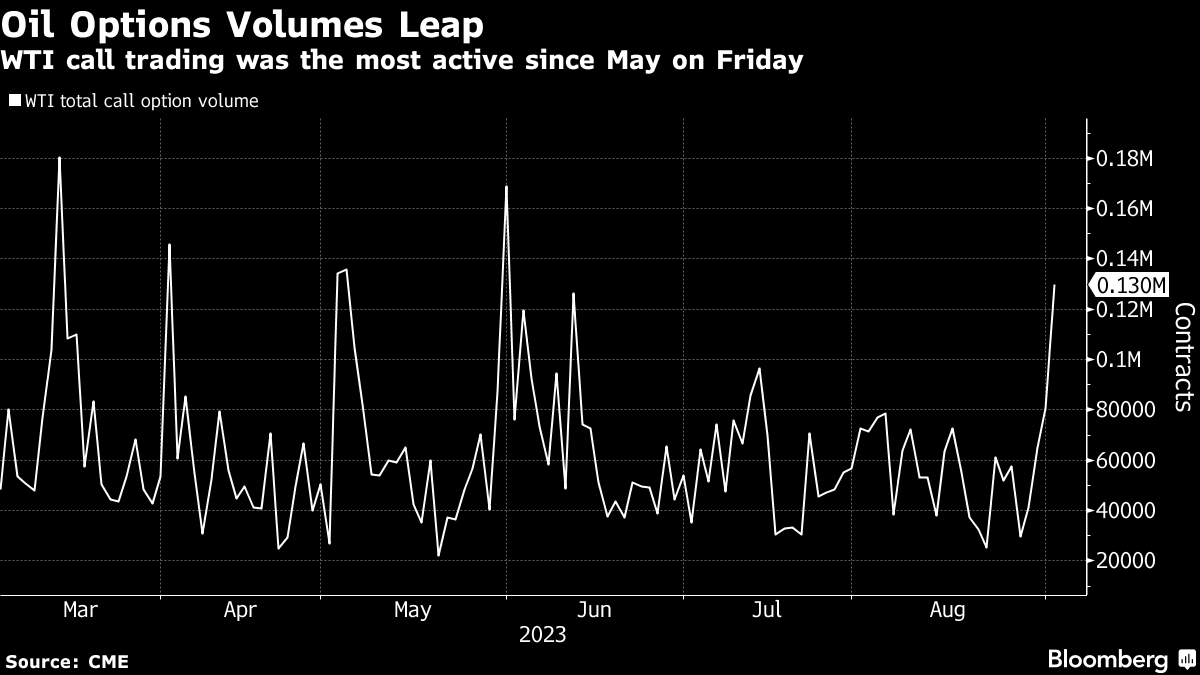

Options markets have seen flurries of bullish activity in recent weeks, with call volumes on US futures rising Friday to their highest since May.

Crude’s recent rally has been driven by cuts from OPEC+ leaders Saudi Arabia and Russia, which are expected to announce their next steps in coming days.

“We think oil prices could be supported over the near term amid the anticipation of persistent supply tightness,” Bank of China International analysts, including Xiao Fu, wrote in a note. “Saudi Arabia and Russia are expected to extend their voluntary production cuts into October.”

At an industry conference in Singapore, Trafigura Group’s co-head of oil trading, Ben Luckock, said the market may be prone to price spikes.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company