Oil Ticks Higher After Two-Day Swing as OPEC+ Countdown Begins

(Bloomberg) -- Oil edged higher after a two-day swing as investors looked ahead to an OPEC+ meeting on supply policy that will shape market balances into 2024, and a weaker US dollar made commodities more attractive.

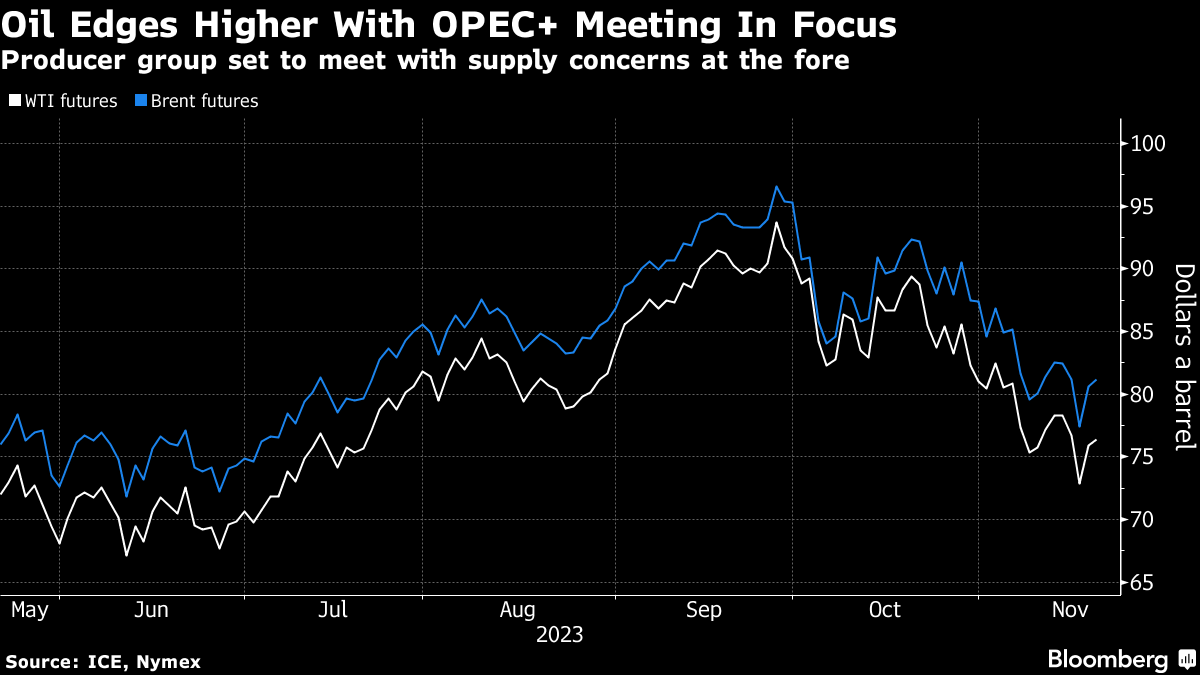

Benchmark Brent rose above $81 a barrel after rallying more than 4% on Friday following a plunge of a similar magnitude the day before. West Texas Intermediate traded over $76 after also having a volatile ride.

The Organization of Petroleum Exporting Countries and its allies are scheduled to meet over the weekend to review the global crude market and decide on priorities heading into the new year. With prices lower year-to-date after a run of four weekly losses, there’s speculation supply curbs will be extended.

“We continue to expect that Saudi Arabia and Russia will roll over their additional voluntary cuts into early 2024,” said Warren Patterson, head of commodities strategy for ING Groep NV. “However, what is less clear is whether the broader OPEC+ group will make further cuts.”

Crude has faced headwinds over the past month as the war-risk premium generated by the Israel-Hamas war largely faded away, and concerns escalated over robust supplies, including from non-OPEC+ nations. With inventories swelling in the US and timespreads signaling weaker conditions, hedge funds have slashed their bets on oil to the least bullish in 20 weeks.

Crude got an additional tailwind from a weaker US dollar. A Bloomberg gauge of the greenback declined by 0.2%, heading for its lowest close since late August. That makes commodities more attractive for most overseas buyers.

In the Middle East, meanwhile, shipping risks were in focus after a Japanese-chartered vessel was seized in the Red Sea by Iran-backed Houthi rebels. Tokyo-based Nippon Yusen KK said the Galaxy Leader, a vehicle carrier, was taken in the southern part of the waterway on Sunday.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output