Stocks Rise as Bond Yields Halt Surge; Oil Tumbles: Markets Wrap

(Bloomberg) -- Stocks rose as Treasury yields halted a surge that drove them to multiyear highs, while a plunge in oil eased concern about further inflation pressures that could imperil the Federal Reserve’s war against inflation.

The S&P 500 rebounded from the lowest since mid-July, led by defensive groups. At a presentation dubbed “Far Out,” Apple Inc. is set to unveil the iPhone 14 line, a fresh slate of smartwatches and new AirPods. West Texas Intermediate crude slumped below $85 a barrel. A dollar gauge pared gains while remaining at record levels. The greenback’s dominance drove gold near the “danger zone” of $1,700 per ounce.

The pound slid to its weakest level in close to four decades, weighed down by a dire economic outlook and the latest bout of US dollar strength. The Japanese yen dropped to a fresh 24-year low versus the greenback and speculation is swirling about the prospects for direct intervention. South Korea’s won weakened to levels not seen since 2009 and China’s yuan was within a whisker of cracking the psychological 7 barrier.

In the final week before officials enter a blackout period ahead of the Fed’s Sept. 20-21 policy meeting, a hefty lineup of central bankers will offer their views. Fed Bank of Cleveland President Loretta Mester warned against declaring early victory on inflation, saying that she would like to see several months of declines in month-over-month readings before concluding that prices have peaked. The Beige Book due at 2 p.m. Washington time will be dissected for signs of moderating economic momentum.

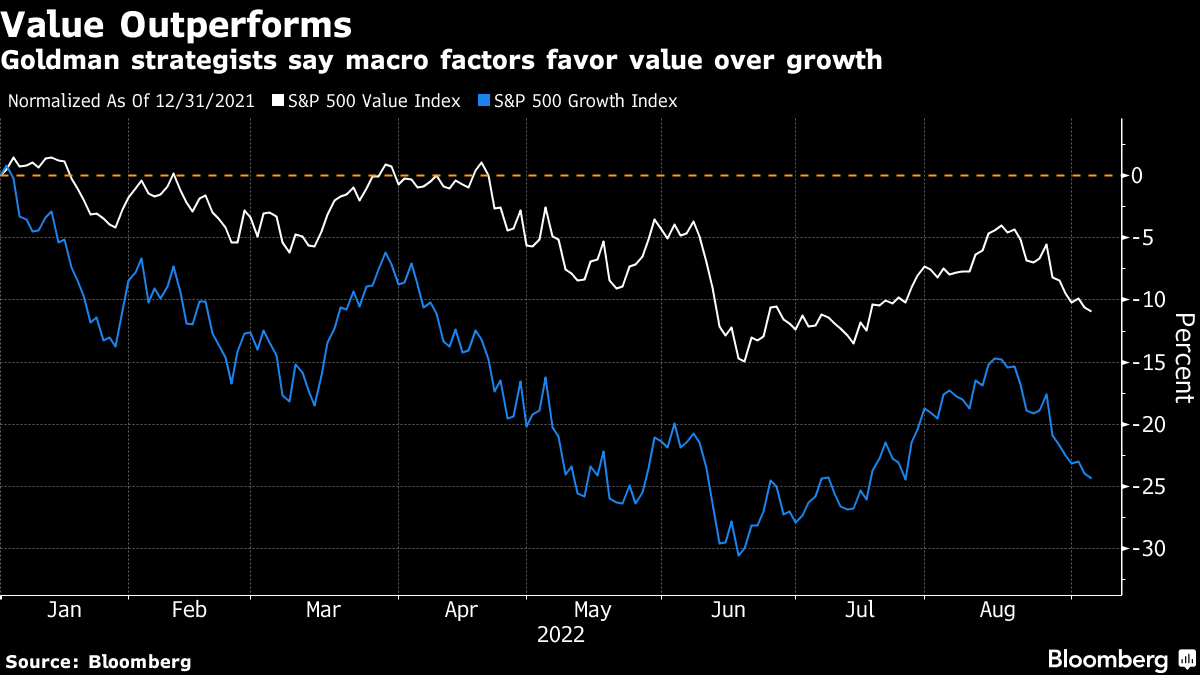

The weakening economy favors continued outperformance for cheaper, so-called value stocks over their growth equivalents, according to Goldman Sachs Group Inc. strategists. The S&P 500 Growth Index trades at a 42% premium to its value counterpart, above the average over the past decade of a 35% premium.

“History shows value stocks outperform around the start of recessions,” strategists led by Cormac Conners wrote in a note. Goldman economists forecast a one in three probability of a recession in the coming year.

Read: Goldman Strategists Warn Stocks Yet to Make ‘Decisive’ Low

What to watch this week:

- European Central Bank rate decision, Thursday

- Fed Chair Jerome Powell due to speak, Thursday

- Chicago Fed President Charles Evans and his Minneapolis counterpart Neel Kashkari due to speak, Thursday

- EU energy ministers extraordinary meeting on emergency intervention in electricity markets, Friday

Are you bullish on energy-related assets? This week’s MLIV Pulse survey focuses on energy and commodities. Please click here to participate anonymously.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4% as of 10:28 a.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average rose 0.4%

- The Stoxx Europe 600 fell 0.7%

- The MSCI World index fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro rose 0.3% to $0.9933

- The British pound fell 0.7% to $1.1440

- The Japanese yen fell 1.3% to 144.70 per dollar

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.29%

- Germany’s 10-year yield declined seven basis points to 1.57%

- Britain’s 10-year yield declined eight basis points to 3.02%

Commodities

- West Texas Intermediate crude fell 3.4% to $83.90 a barrel

- Gold futures rose 0.3% to $1,718.70 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad