Oil Shrugs Off First Rise in U.S. Crude Supplies Since July

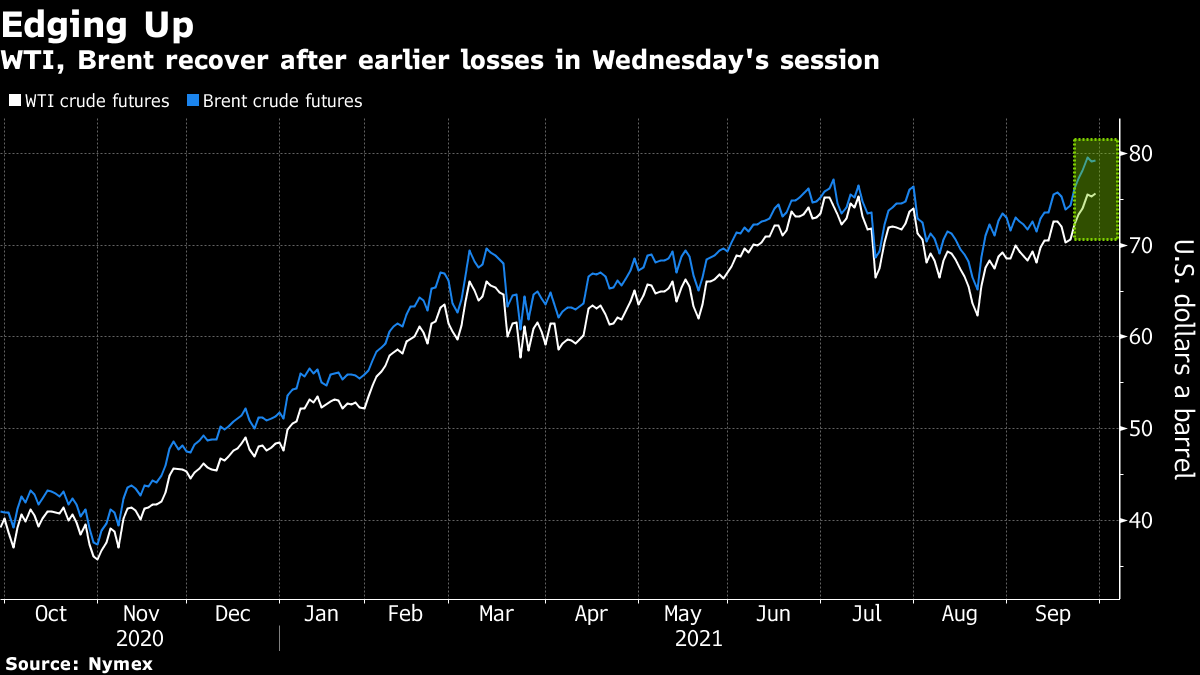

(Bloomberg) -- Oil advanced in tandem with broader markets, ignoring a U.S. government report showing crude stockpiles rose for the first time in eight weeks.

Futures in New York edged up in choppy trading after earlier falling as much as 2.1% on Wednesday. The more-than 4 million-barrel increase in U.S. crude stockpiles failed to keep futures lower amid continued signs of a global energy crunch.

“These moves have a lot to do with global energy shortages,” said Quinn Kiley, a portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets. “There are real issues happening in Europe and Asia. There’s a lot of volatility around the global issues and this just adds confusion.”

Oil’s advance earlier this week -- and Brent’s surge above $80 a barrel -- reflected signs of a tighter global market amid stronger demand and rising natural gas prices. Higher energy costs this month have stoked speculation that the Organization of Petroleum Exporting Countries and its allies may ease supply cuts more quickly. The White House said Tuesday it’s continuing to talk to OPEC and other international partners about the importance of competitive markets and doing more to support the recovery.

Meanwhile, world oil supply is expected to be 1.2 million barrels a day below demand in October, and 900,000 barrels a day in November, according to a OPEC secretariat document being reviewed by the group’s Joint Technical Committee.

In addition to the crude stockpile rise in the U.S. last week, gasoline inventories rose for a second week and distillate inventories climbed for the first time since late August, Energy Information Administration data show. Yet, U.S. crude exports jumped above 3 million barrels a day, signaling stronger global demand.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output