Oil Extends Drop With Rising U.S. Fuel Stockpiles Denting Rally

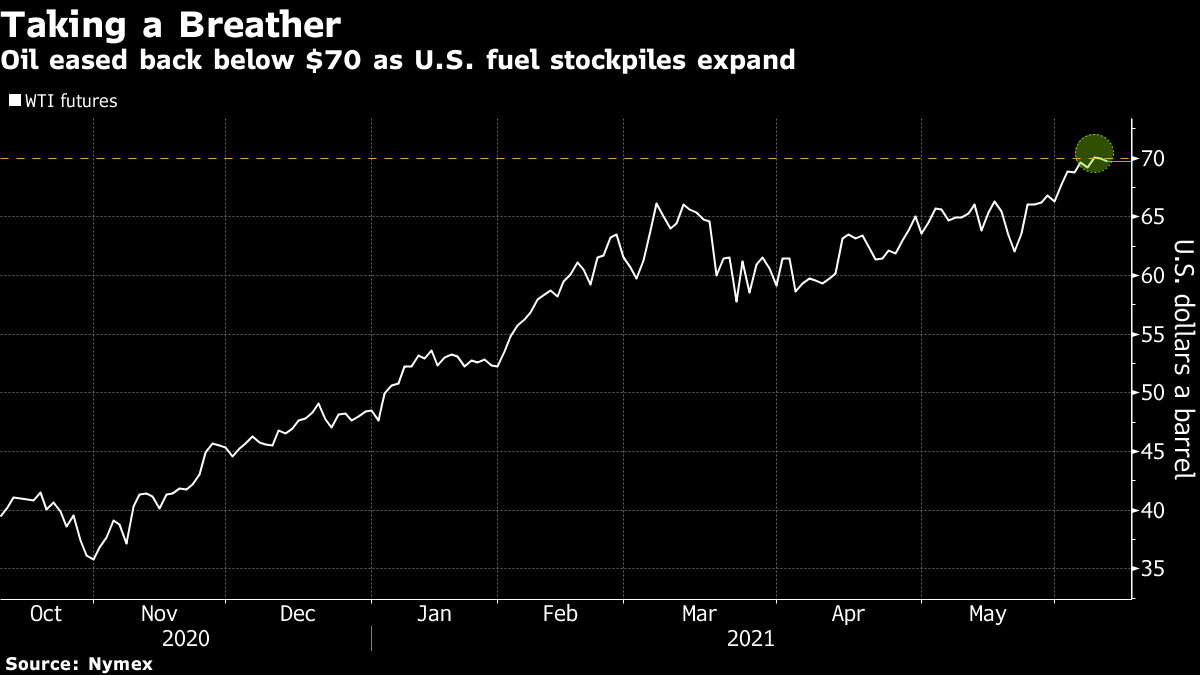

(Bloomberg) -- Oil extended declines as rising U.S. fuel stockpiles punctured the optimism on demand that drove crude to the highest since 2018 this week.

Futures in New York fell 0.7% after slipping back below $70 a barrel Wednesday. American gasoline inventories increased the most since April 2020 last week as refiners eager to boost output to meet an expected surge in consumption over summer left the country awash with fuel. A rolling average of demand ticked lower for the first time in a month, adding to the bearish sentiment.

Stockpiles of U.S. distillates -- a category that includes diesel -- also climbed, but it’s unlikely that a week of growing refined products will derail the broader market recovery, which has been underpinned by a robust rebound in demand from China to Europe. A Covid-19 resurgence in Asia has stunted the global recovery, although there are signs of improvement in the region.

Shrinking American crude stockpiles provided a hint of optimism to the otherwise bearish government data on Wednesday. Inventories slid by more than 5 million barrels last week, according to the Energy Information Administration, more than the median forecast in a Bloomberg survey.

The build in gasoline stockpiles is likely to be a “” and there will be material draws during the driving season,” said Wayne Gordon, a strategist at UBS Wealth Management. “We continue to see incremental improvement on the mobility side, not just the U.S., but also in Europe.”

The market has continued to firm in a bullish structure. The prompt timespread for Brent was 50 cents in backwardation -- where near-dated prices are more expensive than later-dated ones. That compares with 38 cents on Monday.

See also: Iran Plots Oil Output Hike as It Sees Nuclear Talks Progress

U.S. gasoline inventories rose by more than 7 million barrels for a second weekly gain, according to the EIA. Weekly gasoline supplied, which the U.S. government uses as a proxy of demand for the fuel, posted its biggest drop since February when the country was hit by an unprecedented polar blast.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output