High-Stakes Oil Diplomacy Puts Future of OPEC+ Deal At Risk

(Bloomberg) -- A high-stakes game of oil diplomacy pits Saudi Arabia against long-time ally Abu Dhabi. And the result of their fight will shape not just the price of oil for the next year, but the future of the global energy industry.

The United Arab Emirates blocked on Friday an OPEC+ deal that cartel leaders Russia and Saudi Arabia hashed out to increase output, demanding better terms for itself. After two days of bitter talks, and with the UAE the only holdout, ministers halted negotiations until Monday, leaving markets in limbo as oil continued its inflationary surge above $75 a barrel.

Abu Dhabi is forcing its allies into a difficult position: accept its demands, or risk unraveling the OPEC+ alliance. Failure to reach a deal would squeeze an already tight market, potentially sending crude prices sharply higher. But a more dramatic scenario is also in play -- OPEC+ unity may break down entirely, risking a free-for-all that would crash prices in a repeat of the crisis last year.

Crown Prince Mohammed bin Zayed

Photographer: Andy Rain/EPA/Bloomberg

As in all negotiations, there may be an element of bluff. Late last year, Abu Dhabi even floated the idea of leaving OPEC. While this time the UAE hasn’t repeated the threat, no one even at the heart of the talks is sure what could happen if negotiations fail on Monday.

An exit would almost certainly trigger a price war -- and in that scenario everyone loses. The bluff is to show your country is ready to take the pain better than the others.

But there’s also a more subtle poker game playing out, and in that hand, the UAE has some cards. The country wants to pump more oil after spending billions to increase production capacity. At some point, the others in the alliance will probably have to recognize Abu Dhabi’s new status, redrawing the terms of engagement to allow it to pump more.

“The UAE will push hard at this juncture to use this meeting to get their excess capacity recognized and brought back online,” said Roger Diwan, oil analyst at consultant IHS Markit Ltd. “Compromise exists, but it is just how they bring their capacity, not if.”

OPEC Math

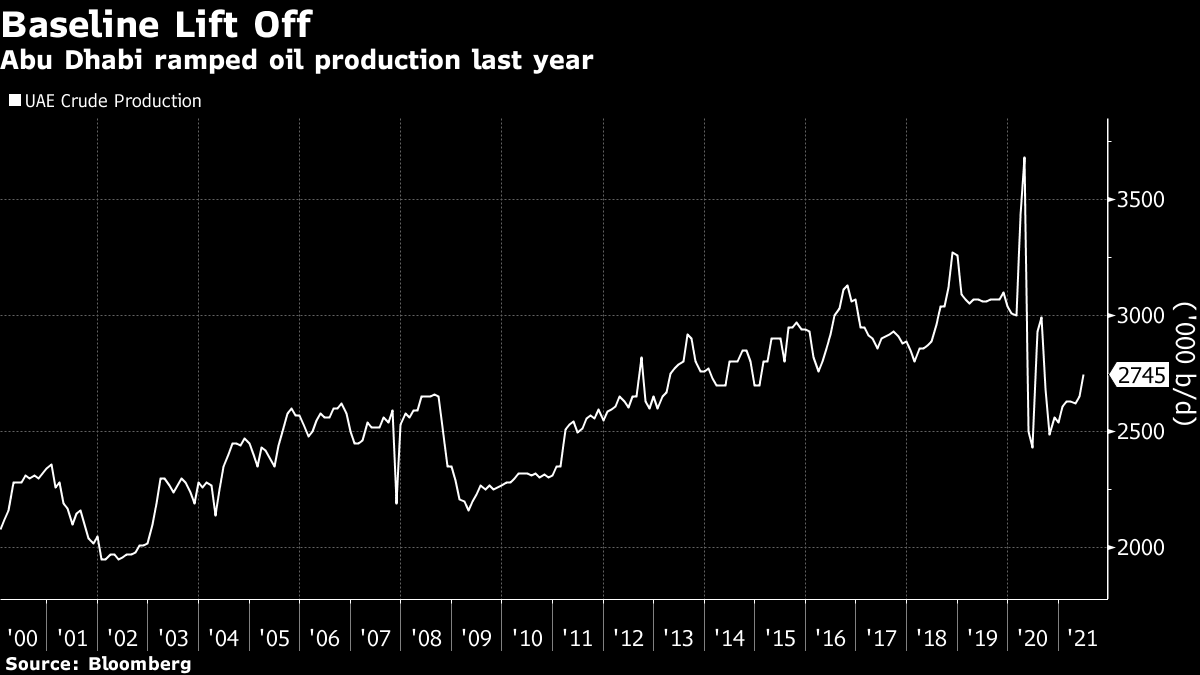

At the center of the dispute is a word key to OPEC+ output agreements: baselines. Each country measures its production cuts or increases against a baseline. The higher that number, the more a country will be allowed to pump. The UAE says its current level, set at about 3.2 million barrels a day in April 2020, is too low, and says it should be 3.8 million.

“This was an inevitable fight,” said Ben Cahill, a senior fellow at the Center for Strategic and International Studies in Washington. “The differences are real and the UAE will continue to make noise until it achieves a higher baseline.”

The current OPEC+ production deal ends in April 2022, when every country will be able to re-negotiate its baseline. But now Saudi Arabia and Russia, with the support of everyone else at OPEC+, want to extend the agreement to the end of next year. The UAE has rejected the idea of extending the broader accord unless its baseline is changed, effectively killing the proposal negotiated by Moscow and Riyadh.

In April 2020, Abu Dhabi accepted its current baseline, but it doesn’t want the straightjacket to stay on for even longer. Abu Dhabi has spent heavily to expand production capacity, attracting foreign companies including French oil giant TotalEnergies SE. With Iran potentially returning to the oil market soon if it reaches a nuclear deal, patience for getting new terms is wearing out.

Good Cards

Claiming a higher baseline is different to having one. Often countries make outlandish declarations of how much oil they can produce -- just to get a better deal. Few take those assertions seriously.

But last year the UAE proved it had the extra barrels. During the price war, it pumped a record of 3.84 million barrels a day, according to OPEC estimates. Abu Dhabi says it produced more than 4 million. Before then, it had never produced more than 3.2 million and few believed it was able to produce much more. Now it can prove it has the barrels, that strengthens its hand in the negotiation.

The Emirate proposal would even benefit Saudi Arabia, which could also secure for itself a higher baseline. But Riyadh has rejected it. The biggest loser would be Russia, which would see a much lower output target. And Saudi Arabia needs Russia onside.

Aside from cartel arithmetic, geopolitical tensions are also in play.

The country’s de facto ruler, Crown Prince Mohammed bin Zayed, once enjoyed close relations with the Saudi Crown Prince, Mohammed bin Salman. But the relationship between the two heirs appears to have cooled in recent months. And Abu Dhabi is flexing its muscles beyond the oil market, with bold geopolitical moves from Yemen to Israel. In another sign of tension as the OPEC standoff intensified on Friday night, Saudi Arabia moved to restrict citizens’ travel to the UAE, citing the pandemic.

Bad Timing

OPEC has been here before. There’s often friction in member countries between the oil ministry, which deals with the cartel and commits to quotas, and the national oil companies, whose priority often is to expand production capacity. In this case, Sultan Al Jaber, the head of the Abu Dhabi National Oil Co., led the charge to increase capacity.

In the 1990s, it was Petroleos de Venezuela SA, the state-owned company of the Latin America country, which pushed ahead with an aggressive capacity expansion. With oil demand growing slowly in the 1990s, Caracas and Riyadh clashed, and the fight ultimately triggered a price war in 1998 that saw Brent crude plunge below $10 a barrel.

Crown Prince Mohammed bin Salman

Photographer: Luke MacGregor/Bloomberg

In the 2000s, Algerian national energy giant Sonatrach SpA did the same, but benefited from better timing: booming Chinese oil demand allowed it to lift production 60% from 1996 to 2006 with the tacit consent of OPEC.

Adnoc’s push was hindered by two factors: U.S. shale production and the coronavirus pandemic, both of which dented demand for OPEC barrels over the last five years. Al Jaber misread the market, or was unlucky with the timing.

Who wins the standoff this time may depend on luck, a bit of bluffing, and who fears he has the most to lose from OPEC unraveling.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company