Oil Extends Retreat as Delta Takes Toll on China, U.S. Rigs Rise

(Bloomberg) -- Oil dropped for a third straight day as the continued spread of the delta coronavirus variant hurt prospects for global demand just as drilling data from the U.S. pointed to increased activity.

West Texas Intermediate slumped 1.1% after a 0.9% loss on Friday. In Asia, fresh virus outbreaks have started weighing on China’s economy, with retail sales growth and industrial output slowing. Meanwhile, cases are at or near records in nations including Thailand, Vietnam and the Philippines.

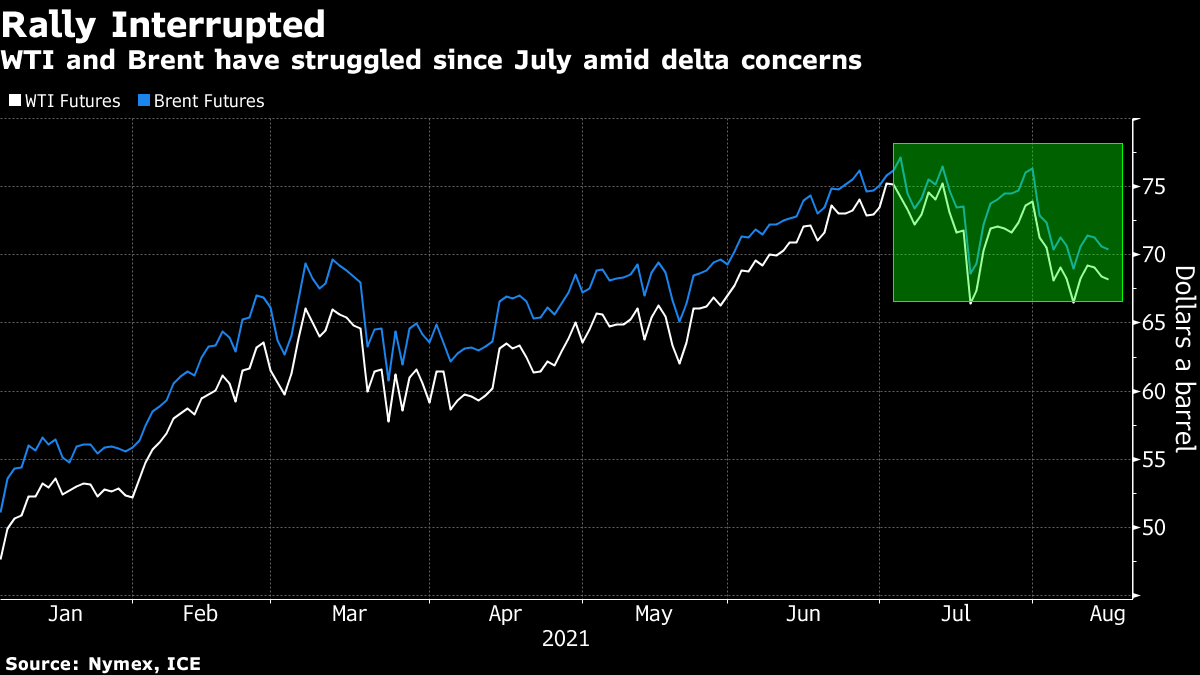

After soaring in the first half, crude oil’s rally has started to fray since mid-July. The spread of delta, including in key consumer China, has undermined the outlook for consumption as restrictions on mobility are reintroduced. At the same time, OPEC+ has proceeded with plans to gradually increase production, rolling back the supply curbs it imposed in the early days of the pandemic.

“The delta worries are tightening their grip on oil market sentiment,” said Vandana Hari, founder of energy consultant Vanda Insights, adding that the summer travel and tourism boom in the West is petering out. “The market will likely remain in flux, at least until the delta wave shows a significant and sustained retreat, especially in the U.S. and China.”

China has been dealing with its most widespread Covid-19 outbreak since the initial cases in 2020, with fresh lockdowns imposed. Data on Monday showed the nation’s economic activity slowed more than expected in July, with retail sales and industrial output missing forecasts as unemployment rose.

There are signs U.S. shale producers are ramping up activities. The total number of rigs searching for oil across the country rose by 10 last week to 397, marking the biggest weekly jump since April, according to Baker Hughes Inc. data on Friday. Most of the gains came outside the Permian Basin.

Crude’s drop has been reflected in the market’s deteriorating pricing patterns. Brent’s time spread was 40 cents a barrel in backwardation on Monday. While that remains a bullish structure, it’s down from above 90 cents in late July.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output