Canadian Energy Stocks Climb to First Record Since 2008

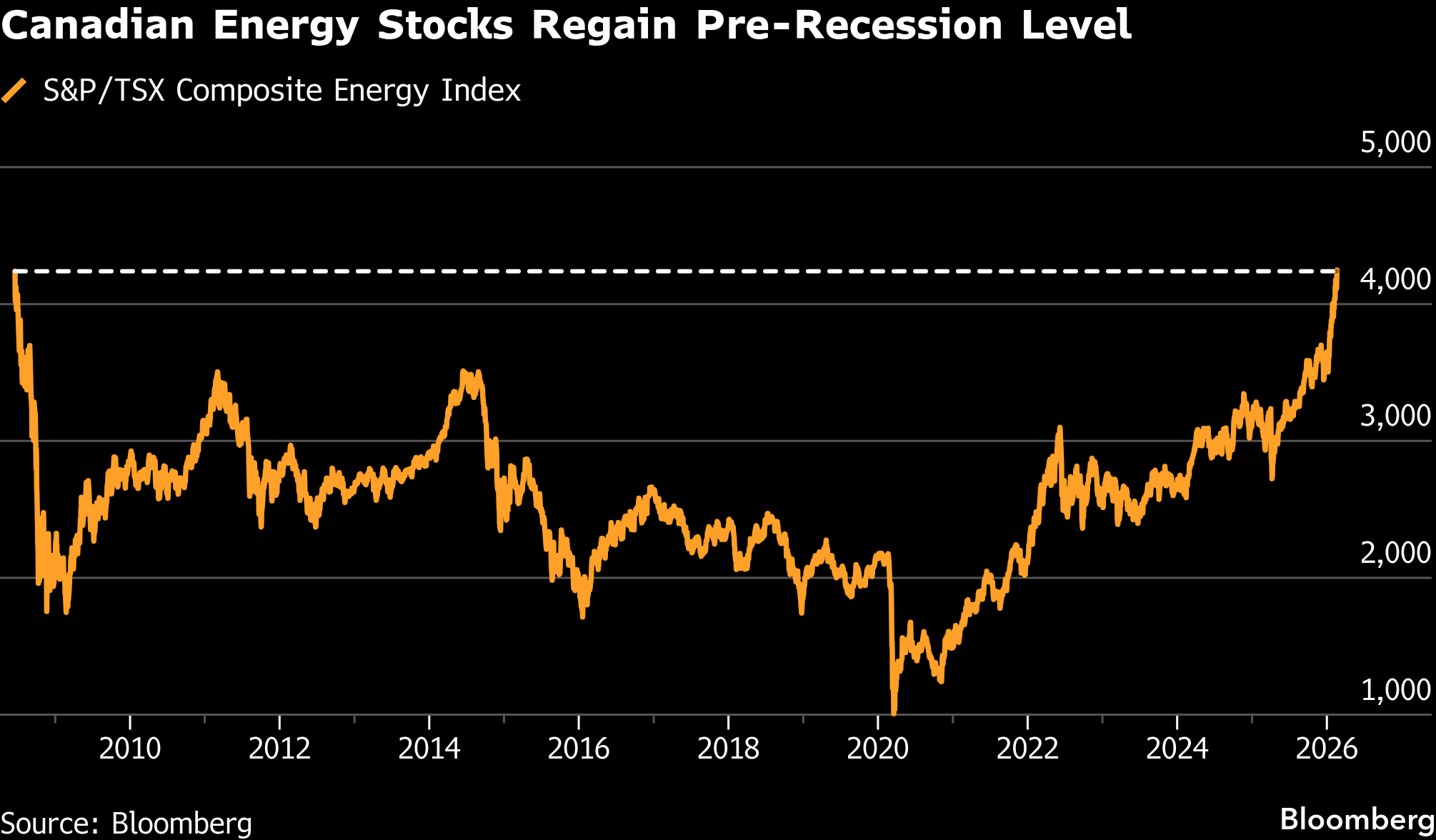

(Bloomberg) -- Canadian energy shares had their first record close in nearly eighteen years, helped by rising oil and natural gas prices and a return of investor interest in the sector.

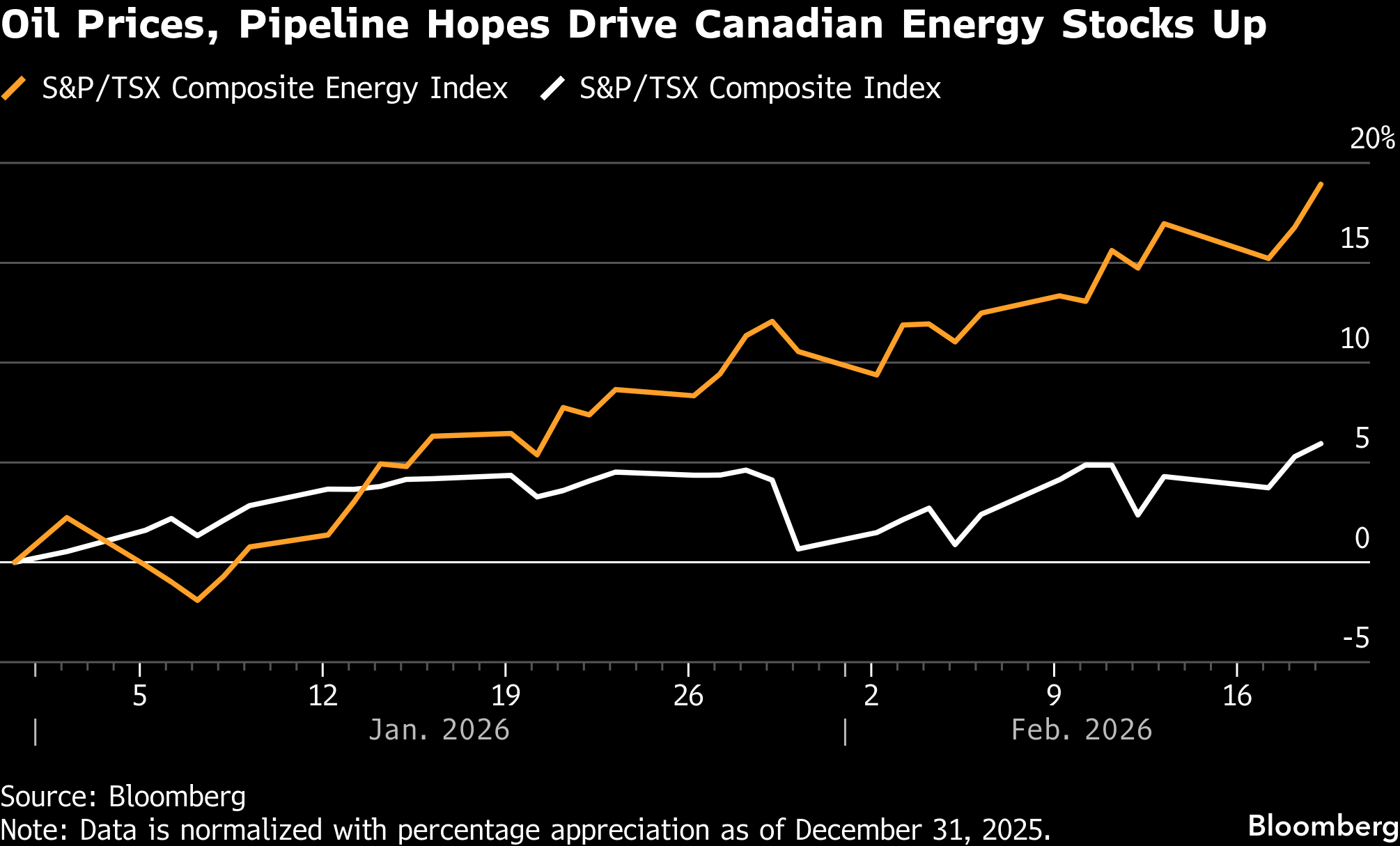

Oil surged this week as traders weighed whether US-Iran talks will be enough to head off conflict after a report suggested US military intervention could come sooner than expected. The S&P/TSX Composite Energy Index rose 1.8% on Thursday, leading the group to an all-time high for the first time since June 2008. The index is up 19% this year, versus a 5.9% advance for the S&P/TSX Composite Index.

Oil prices have risen on a run of geopolitical flash points involving Russia, Ukraine, Iran, Greenland and Venezuela. Brent crude futures are up 18% so far this year. Natural gas prices also jumped early in 2026 as winter storms lifted demand.

“The fact that it’s taken well over a decade to return to the highs probably speaks to how long and persistent this sector was generally out of favor relative to some of the asset-light and higher growth sectors that are out there,” ATB Cormark Capital Markets research director Patrick O’Rourke said in an interview.

Government policy has also helped. Prime Minister Mark Carney has leaned into the country’s oil industry since taking office in March 2025 and his government signed a memorandum of understanding with Alberta in November that could clear a path for a new export pipeline, part of a broader push to diversify trade away from the US.

The new line could widen access to markets such as Asia and support higher output over time.

Canadian Natural Resources Ltd. shares are up 25% this year, and O’Rourke said the company could benefit from any added capacity — though he also cautioned that big growth decisions tend to wait for clearer execution.

“Elements like the MOU that has been signed with Alberta are positive, but still I think at the end of the day, words are nice, but actions are a lot more meaningful,” O’Rourke said.

Energy stocks have also seen gains as their fundamentals have strengthened with balance sheets and profitability improving in recent years, according to O’Rourke. Companies have increased their capital discipline by improving their cost structure, increasing free cash flow and benefiting from lower cost of supply for Canadian oil.

Enbridge Inc. saw its earnings rise around 8% in 2025, while Suncor Energy Inc. saw its net debt fall by over 40% last year.

Canadian energy stocks have also got a lift as traders moved away from investments pegged to environmental, social and governance frameworks amid rising geopolitical tensions, according to TD Securities research director Menno Hulshof. The shift muted the appetite for decarbonization-related themes, which would have led to a reduction in demand for traditional energy.

“The vast majority of energy investors would say that on balance energy security is a lot more important than transition and ESG, and we can debate whether that’s right or wrong, but that’s just the reality,” Hulshof said in an interview. “Most of our oil production is long life low decline, which of course has value for investors that believe that hydrocarbon consumption is going to last longer than a lot of people thought it would.”

Risks remain. The sector is still largely at the mercy of macro swings — and the policy backdrop has been volatile, including the January upheaval in Venezuela that briefly widened the discount on Canadian heavy crude. Executives at Enbridge have said shippers remain interested in moving more barrels to the Gulf Coast, while Imperial Oil Ltd. has described the Venezuela impact as marginal.

Beyond prices, O’Rourke said part of the story is simple positioning: investors spent years underweight the group, and some are now rebuilding exposure.

“A lot of portfolio managers and institutional capital as a pool have broadly been underweight energy, both north and south of the border,” O’Rourke said. “As you’re seeing a rotation from asset-light business models, like tech, etc., that capital has has come into asset-heavier business models, the first wave was based on precious metals, and now we’re seeing that capital increased weight in the energy sector.”

(Updates with closing prices.)

©2026 Bloomberg L.P.