Canada's Oil Sands Exports to Asia Reach Record With New Link

(Bloomberg) -- Canada's oil sands producers were able to export a record amount of crude to overseas markets thanks to a new link to the U.S. Gulf Coast.

The recent reversal of Marathon Pipe Line Inc.’s Capline pipeline is sending oil sands crude produced in landlocked Alberta to export terminals on Gulf Coast where it can be shipped to other countries. Exports to Asia were at their highest ever, with India the leading destination by far, followed by China and then South Korea, according to oil analytics firm Kpler.

The development marks a sea change for Canada’s oil industry. The country holds the third highest crude reserves in the world, but exports to markets beyond the U.S. have been limited due to a lack of infrastructure. Canada has faced severe opposition from activists for building pipelines from the oil sands region to British Columbia’s Pacific Coast. Additionally, the Biden Administration last year blocked the Keystone XL pipeline, effectively shutting Canada’s crude out of the global market.

“Looking ahead, Canadian crude exports out of the U.S. Gulf should continue to show strength,” said Matt Smith, oil analyst at Kpler. “With Venezuelan crude exports having tanked in recent years, and now with the prospect of Mexican crude being taken off the market, Canadian crude appears to be one of the leading beneficiaries of these changing dynamics.”

Shipments of heavy crude jumped to more than 266,000 barrels a day in December after averaging over 180,000 through the year, according to Kpler. Canadian crude exports from the U.S. Gulf Coast averaged just 25,000 barrels a day in 2018, before rising to average around 70,000 in both 2019 and 2020.

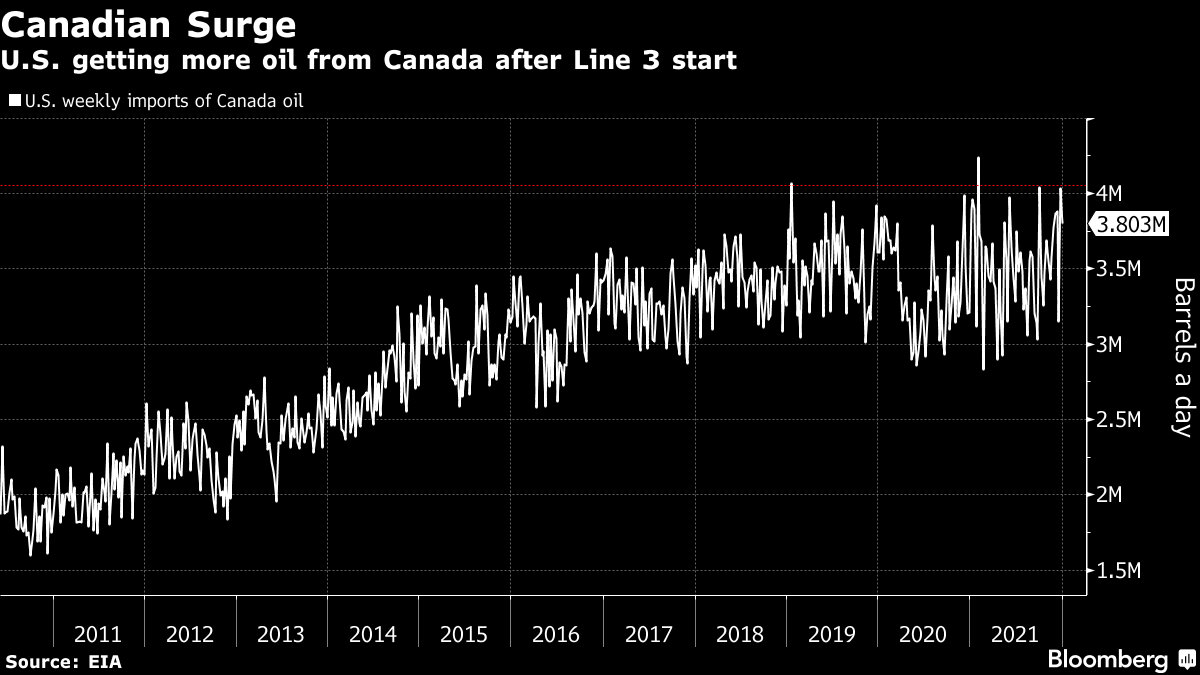

In October, overall Canadian shipments of oil to the U.S. jumped to more than 4 million barrels a day, highest volume since the start of the year thanks in part to the startup of a long-delayed Canadian pipeline.

(Updates with size and scope of exports to Asia in the second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets

ADNOC Gas awards design contract for gas processing facilities at Bab Gas Cap