Traders Take Aim at $40 U.S. Natural Gas in Bet on Supply Shock

(Bloomberg) -- The biggest rally in U.S. natural gas futures since the beginning of the century has some traders betting that prices will spike to an unheard-of $40 per million British thermal units.

Two contracts for March $40 European-style call options traded Monday and one traded on Tuesday, selling for as much as 10.5 cents. That $1,050 investment would only pay off if Henry Hub futures on the New York Mercantile Exchange rise by more than seven times the current March futures price by the time the option expires on Feb. 23.

Options are a relatively cheap way to wager on the direction of commodities markets because they’re vastly less expensive than futures contracts and don’t commit the buyer to deliver physical supplies at expiration.

Gas prices have risen sharply in the U.S., but are well below international levels, boosting speculation that more domestic supply will head overseas amid shortages in Europe, Latin America and China. With U.S. stockpiles already lower than normal, a jump in exports heading into the peak winter demand season could trigger price spikes as power plants compete with home heating and industrial use for the fuel.

New York-traded gas futures have more than doubled this year and were trading at $5.636 as of 10:58 a.m. local time. The fuel is on pace for its strongest annual performance since 2000.

But a pullback in futures on Wednesday took a bite out of the March $40 options contract’s value, leaving it worth just 4.22 cents, or $422, on paper.

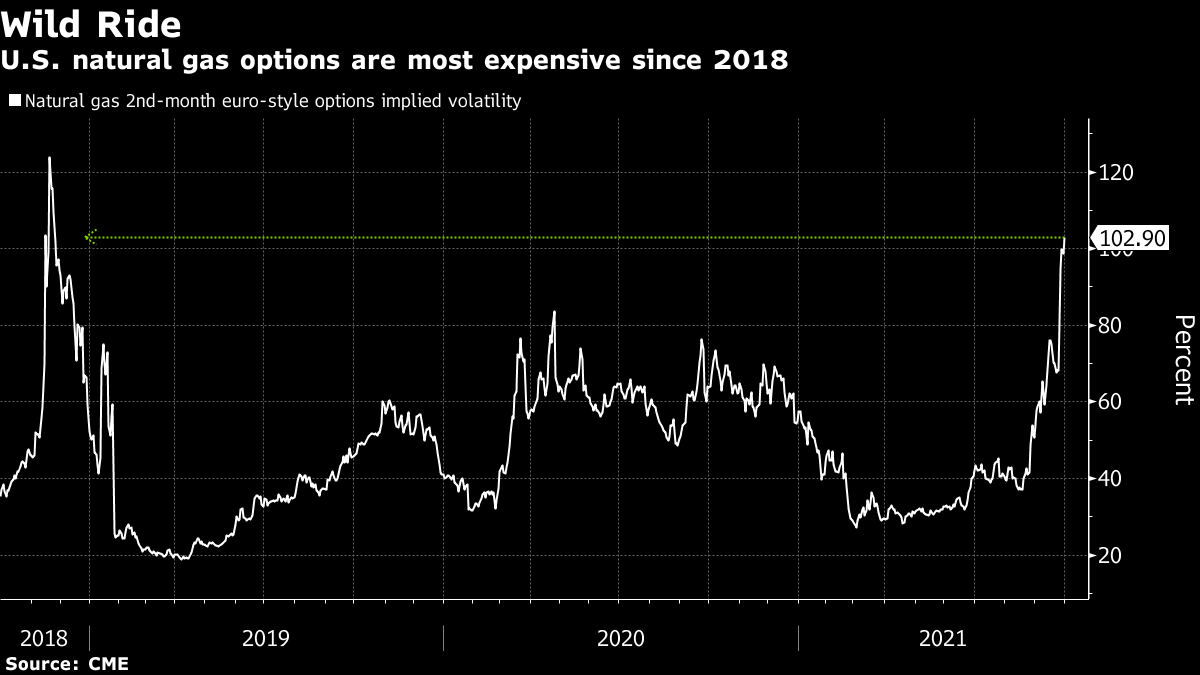

Beyond the lottery-ticket trades, natural gas options are the most expensive since November 2018’s wild ride that sent some investment funds out of business, based on implied volatility for second-month contracts. That previous surge was driven by seasonally low stockpiles heading into winter.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Tesla-Supplier Closure Shows Rising Fallout of Mozambique Unrest

UAE Names Former BP CEO Looney to New Investment Unit Board

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project