Shell Hits the Breaks on Growing Renewables Unit After Record 2022 Profit

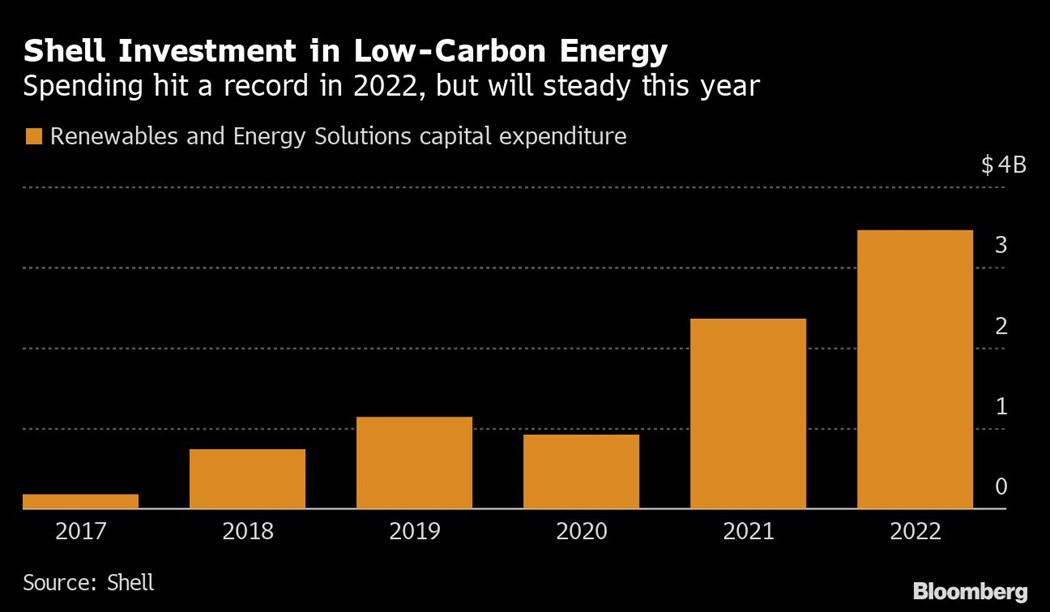

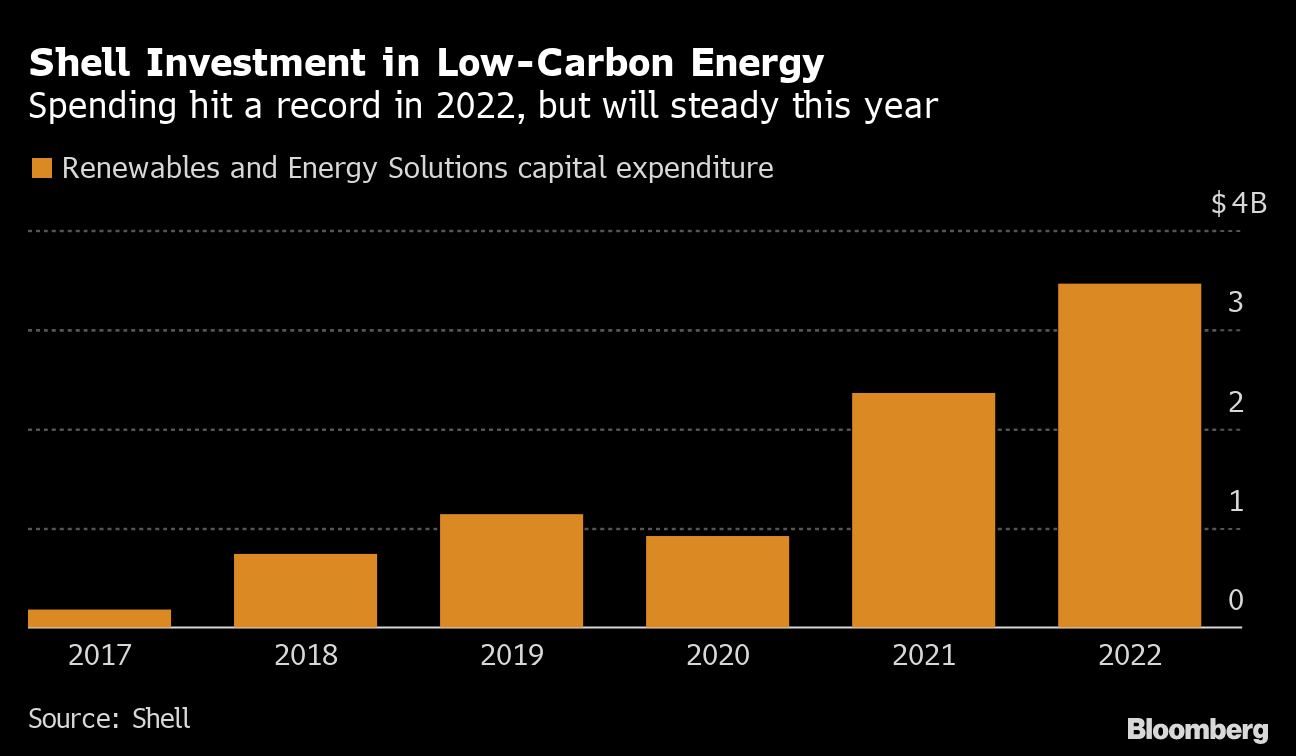

(Bloomberg) -- Shell Plc plans to keep investment in its renewables and energy solutions business steady this year after it hit an all-time high in 2022, a signal that the company’s record profits won’t significantly accelerate its low-carbon ambitions.

Spending on the unit includes a variety of technologies from wind and solar farms, to carbon offsets, carbon capture and biofuels. Shell plans to expand in those areas to reach its goal of net-zero emissions by 2050, with a renewed focus on delivering value to Shell investors, said new Chief Executive Officer Wael Sawan.

“Our philosophy has been a real pivot toward energy transition investments,” Sawan said. “But we will make sure that those investments go into the areas where we can see line of sight toward attractive returns to be able to reward our shareholders.”

Shell invested about $3.5 billion on the renewables and energy solutions business in 2022, making up about 14% of total capital expenditures, according to figures released by the company on Thursday. That level will remain steady in 2023, Chief Financial Officer Sinead Gorman said in a call with reporters Thursday.

Spending on the the unit has risen steadily in recent years as Shell began to diversify away from fossil fuels, the combustion of which is the primary driver of climate change. Even at the record level reached last year, it was still less than half what the company spends on oil and gas exploration and extraction.

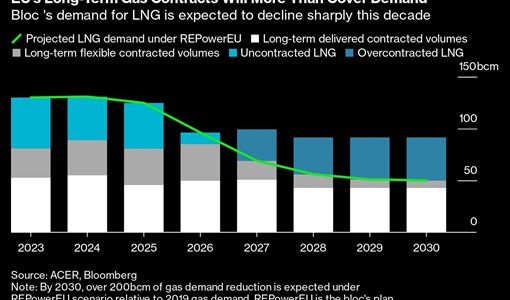

Shell is working to grow its natural gas business, the engine for record profits last year. While gas produces fewer emissions when burned than oil does, the world would need to consume a lot less of it in the coming decades to prevent the worst impacts of global warming, according to models of a future energy system that would reach net-zero emissions by 2050.

Overall, Sawan said the company’s energy-transition spending is greater than the figures included in the renewables unit, making up over a third of overall investment of $23 billion to $27 billion announced for 2023.

“Is the pace of renewables investment fast enough? I don’t think we are moving as a world fast enough,” Sawan said. “But that requires significant change from government policies. It requires the right customer uptake and of course it requires companies like ours to continue to invest.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Clean Hydrogen’s Best Bet May Be a Rainforest State in Borneo

Apr 18, 2024

PG&E, Edison, California Apply for $2 Billion US Grid Grant

Apr 18, 2024

China’s Solar Surge Is Making a Missing Power Data Problem Worse

Apr 18, 2024

First Solar Jumps After Report Says Biden to End Trade Loophole

Apr 17, 2024

Biden’s Climate Law Catalyzed Investment, But Projects Still Face Snags

Apr 17, 2024

Masdar and EGA form alliance on aluminium decarbonisation and renewables

Apr 17, 2024

Chevron Launches $500 Million Fund to Invest in Clean Tech

Apr 16, 2024

Coal Keeps Powering India as Booming Economy Crushes Green Hopes

Apr 16, 2024

Eni company Plenitude commences construction of its largest ever solar project in Spain

Apr 16, 2024

How Amazon Became the Largest Private EV Charging Operator in the US

Apr 15, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

Neway sees strong growth in Africa

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum