How a Soviet Nuclear Site Could Be Key to Europe’s EV Market

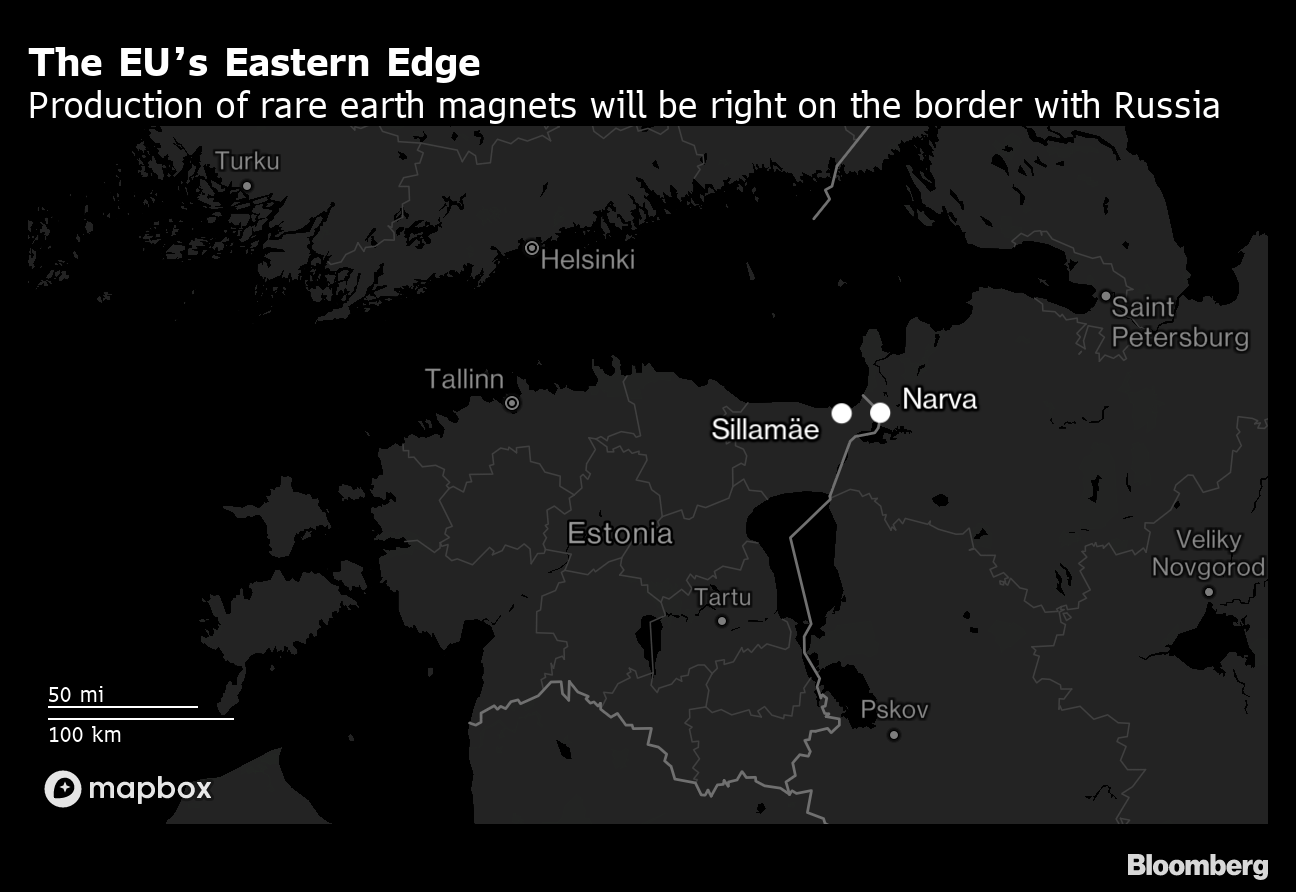

(Bloomberg) -- On the edge of Sillamae, a town of just over 12,000 people in northeast Estonia, sits a grassy hill with a secret.

It’s here, on the Baltic Sea coast close to the Russian border, where the past is buried. And it’s here, according to one company, where the future lies if Europe wants to loosen China’s grip on the supply of components to industries seen as critical to the continent’s economy.

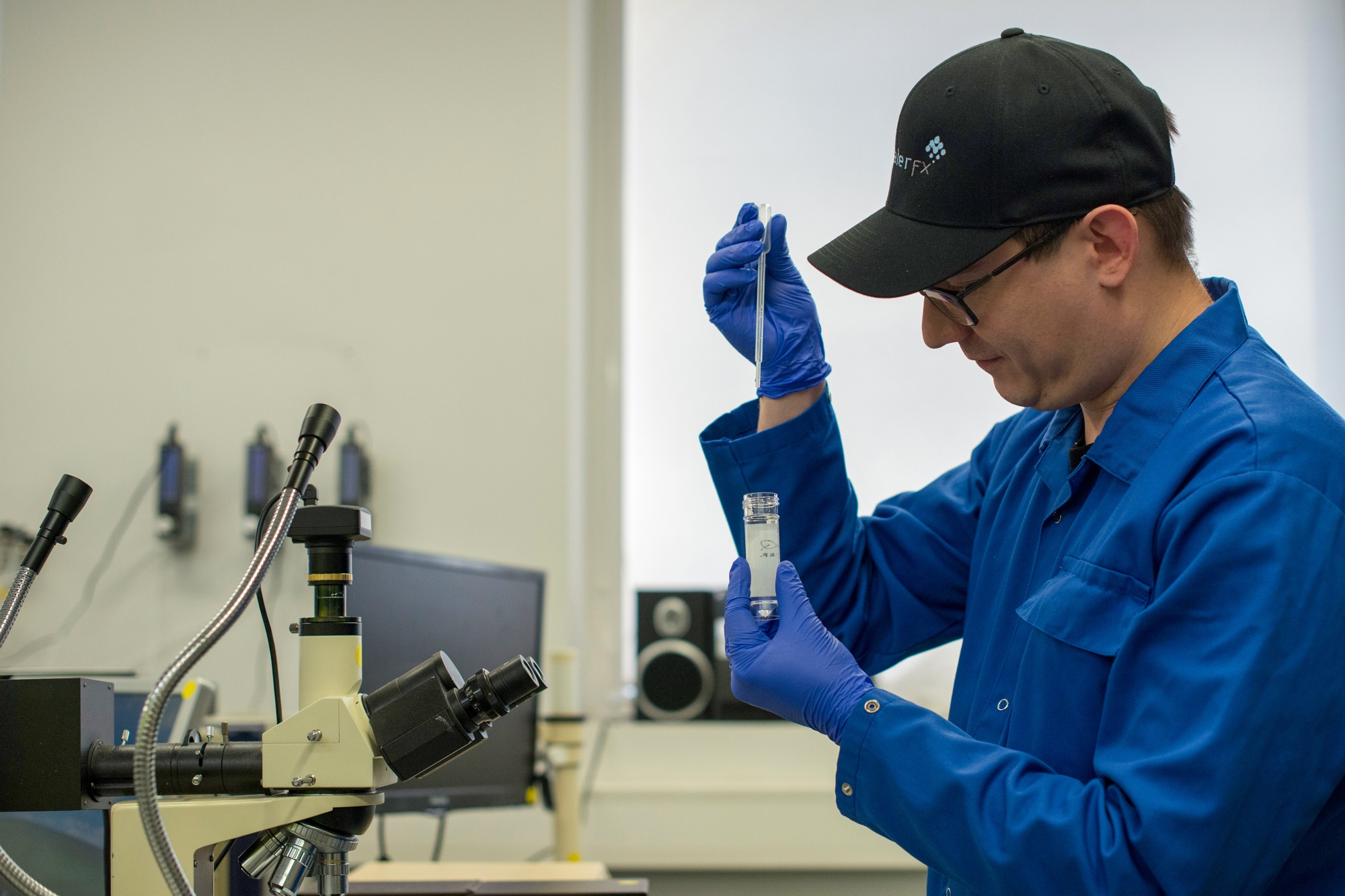

The artificial mound covers a radioactive pond from when the town covertly made uranium for the Soviet nuclear industry until 1989. Today, the adjacent facilities are home to oil and fertilizer storage terminals, but also the only major processing plant outside Asia for rare earth metals used in the automotive industry.

The plant’s Canadian owner, Neo Performance Materials, says the knowledge honed in the remote region over decades is now key to nurturing a European industry for magnets, particularly for electric vehicles. Backed by the Estonian government, Neo plans to build Europe’s first rare earth magnets manufacturing site next door to Sillamae, which will provide the processed raw materials needed to make them.

“You look at the whole of Estonia — 1.4 million people is the size of a small city anywhere else in the world — and yet it has the potential to become an innovation hub for critical materials for all of Europe,” said Constantine Karayannopoulos, Toronto-based Neo’s chief executive officer.

The vision may sound grand, but rare earth metals are in demand and incredibly niche. They are a set of 17 elements from the periodic table and have hundreds of uses, from missiles to banknotes.

The biggest is for making incredibly powerful magnets, which make up about 90% of the market’s value worldwide, according to the industry’s lobby group. Chinese companies dominate production while US and European capabilities have shriveled in the face of cheaper competition over the last three decades.

The electric car industry is going to need a lot more magnets in coming years as the European Union moves to ban internal combustion engines by 2035. The challenge in Europe is sourcing the raw material and then convincing customers it’s worth paying a premium on Chinese products, said Nabeel Mancheri, secretary general of the Rare Earth Industry Association in Belgium.

Neo’s previous owner, Molycorp Inc., was one of several firms that shut down production. It previously attempted to build a mine-to-magnet supply chain — like Neo is now attempting — but failed, partly because of often wild price fluctuations in the rare earth metals market.

“In Europe, it’s a problem of capacity,” said Mancheri. “Magnets is not rocket science. The only problem is that you need to have a close collaboration with supply chain partners from the upstream to the downstream.”

China’s overwhelming sway over rare earths has become more concerning for Western companies after the Covid-19 pandemic, the war in Ukraine and blockages on the Suez Canal exposed the vulnerabilities of supply chains.

Europe’s automotive industry is now establishing its own production of everything from semiconductors and batteries to the lithium used inside them. The region is not just in an accelerating race with China, but also the US, where President Joe Biden is luring manufacturers with some $370 billion worth of clean-technology subsidies in the Inflation Reduction Act.

Companies are also eager to see more localized and ESG-compliant supply chains of magnets and are putting pressure on Neo to establish that capacity, said Karayannopoulos. He said his company is in talks with all of the major electric vehicle drivetrain suppliers, including Robert Bosch GmbH, Schaeffler Group, Siemens AG, Stellantis NV and Tesla Inc.

There are manufacturers “screaming for this European supply chain capability,” said Karayannopoulos, who co-founded Neo 30 years ago. “They expect their tier-one suppliers to respond.”

Neo makes tantalum, cerium, lanthanum, neodymium, praseodymium — materials for automotive, aerospace, microelectronics — in Sillamae. It has about 70% of the market in neodymium magnets outside of China, according to Yuri Lynk, a Montreal-based analyst at Canaccord Genuity. It recently bought exploration rights to a mine in Greenland and also owns magnet plants in China and Thailand.

At the moment, the company has to ship materials processed in Estonia to those facilities in Asia, only to transport the finished product back to customers in Europe. The new €100 million ($106 million) Estonian facility that will be built in Narva, a Russian border city 25 kilometers (16 miles) east of Sillamae, is supposed to solve that.

It will make a magnetic powder essential for electric vehicle drivetrains and the company aims to have it up and running in 2025. The target is to produce 1,500 tons a year initially, worth €150 million in revenue, Karayannopoulos said. At full capacity, it could produce 5,000 tons. To put that into perspective, it would meet demand for all of Europe’s 1.7 million electric vehicle registrations in 2021, he said.

“I don’t think they’d build the plant if they didn’t see the demand there,” said Lynk, the analyst. “They’re a small company, but the market that they’ve traditionally dealt with is a small market.” Neo’s shares have risen 24% since mid November, shortly after it announced the Estonian government would back the new plant with an €18.7 million EU subsidy.

A handful of Neo’s competitors is seeking to build up rare earths capabilities outside of Asia, but most don’t have the head start thanks to the Sillamae facility.

In California, MP Materials, a company that owns the only major rare earths mine in the US, is aiming to build a supply chain. It’s ramped up production so that the US is producing more rare earth minerals than ever before. But the country lacks the refining and magnet-making capabilities, which MP Materials is now trying to fix by building a refinery at its mine and a magnet factory in Texas.

“For the entire industry, the primary driver of growth is traction motors for electric vehicles,” said Matt Sloustcher, a senior vice president for communications at MP Materials.

With refining and production capabilities “systematically offshored and hollowed out” in the US and Europe, MP Materials says the industry has to be rebuilt from the ground up. “China is dominant across mining, refining and the production of metals, alloys and magnets,” said Sloustcher. “And so from a resiliency point of view, that’s a weakness in the global supply chain. That is a threat.”

In Sillamae, the former uranium extraction plant was built by prison labor in the aftermath of World War II. It was sold off by the Estonian government after the tiny nation declared its independence from the Soviet Union in 1991. The covered “Uranium Lake,” which sits less than 50 meters from the Baltic shore, remains contaminated with about 12 million tons of waste.

The town was seen as essential for the nuclear industry back in the day, said Tonis Kalberg, Sillamae’s mayor. Now he talks about renovating the seaside promenade, sailboat rentals and fishing for tourists.

“The whole town was built for the purpose of this plant,” Kalberg said in an interview at his office in the town hall. “It was a closed town. The plant was secret.”

In Narva, which like Sillamae is mainly Russian-speaking, the advent of the new plant would be a timely boost to the city of 54,000 after the war in Ukraine hit the cross-border economy. Estonia’s industrial heartland has long been in decline, precipitated most recently by plans to wind down production at oil shale-fueled power plants, which employ thousands in the region.

Katri Raik, Narva’s mayor, is hopeful that Neo’s plans come through. She’s been fielding calls from an HR company inquiring about kindergartens for Neo employees. The city’s new slogan is “Europe Starts Here.” “We need to applaud the investors who come here next to Russia,” she said. “It’s up to us to convince them they made the right decision.”

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Masdar and EGA form alliance on aluminium decarbonisation and renewables

Apr 17, 2024

Chevron Launches $500 Million Fund to Invest in Clean Tech

Apr 16, 2024

Coal Keeps Powering India as Booming Economy Crushes Green Hopes

Apr 16, 2024

Eni company Plenitude commences construction of its largest ever solar project in Spain

Apr 16, 2024

How Amazon Became the Largest Private EV Charging Operator in the US

Apr 15, 2024

Equinor announces first battery storage projects in the United States

Apr 15, 2024

Japan’s largest power company JERA creates global renewables business headquartered in London

Apr 15, 2024

America’s Corn Belt Bristles at $8 Billion Lifeline

Apr 13, 2024

Generac Eyes Power Deals With $1 Billion to Spend

Apr 12, 2024

The Century-Old Transmission Line Is Getting a 21st Century Upgrade

Apr 12, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

Neway sees strong growth in Africa

Feb 27, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum