Oil Steady After Mixed Stockpile Data as Demand Concerns Linger

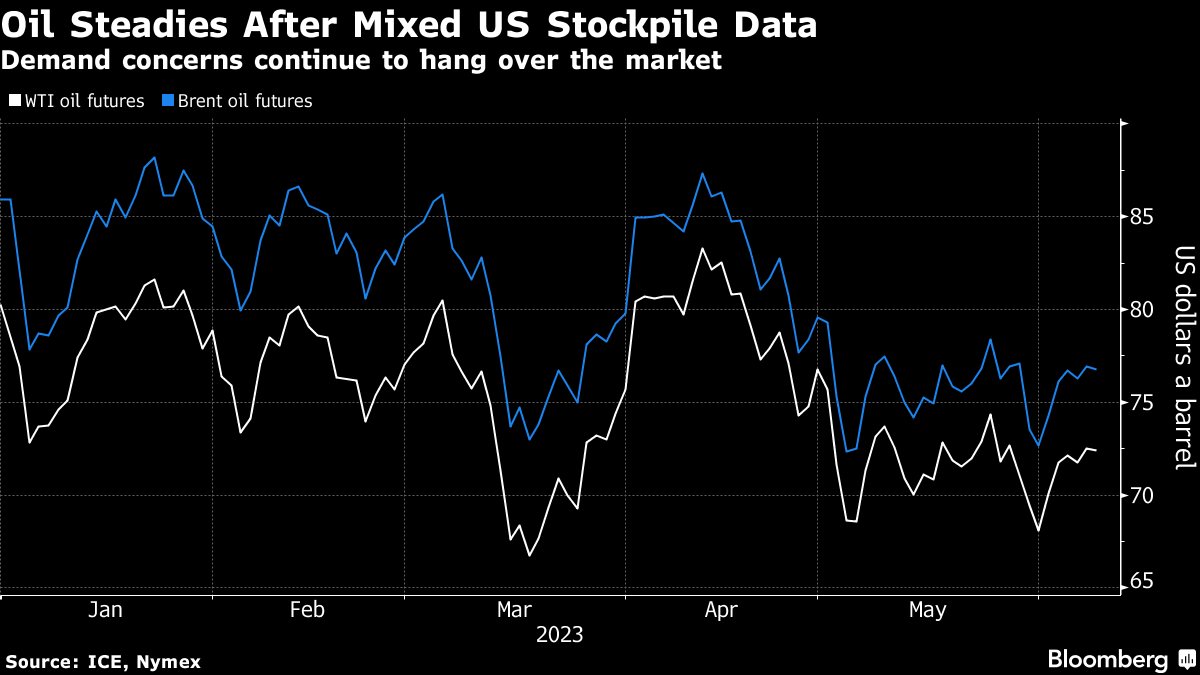

(Bloomberg) -- Oil steadied as investors weighed mixed US data on crude and petroleum stockpiles amid persistent concerns over the demand outlook.

West Texas Intermediate futures traded near $72 a barrel after gaining 1.1% Wednesday. Crude inventories at the Cushing storage hub rose for a seventh week, while gasoline stockpiles also gained, according to government figures. However, refinery utilization was at the highest level since 2019, providing some bullish sentiment for summer demand.

Oil is still down 10% this year as China’s sluggish economic recovery, interest rate hikes from the Federal Reserve and robust Russian crude flows weigh on prices. Investors will also be watching data on jobless claims later Thursday for clues on the path forward for US monetary policy.

“Hawkish tremors are being felt globally, signaling more tightening may be in the pipeline,” said Charu Chanana, market strategist for Saxo Capital Markets Pte. “Current price action is clearly reflective of broader macro concerns.”

Saudi Arabia’s pledge over the weekend to cut more supply from the market in July led to an initial surge in prices on Monday, but optimism around the curbs has quickly faded. Citigroup Inc. said the cut wouldn’t offset weak market fundamentals, with the bank bearish on the outlook for the second half.

While US gasoline stockpiles rose for the first time in five weeks, inventories are still below the five-year seasonal average, according to Energy Information Administration data. The Memorial Day weekend at the end of May is typically the start of the nation’s summer driving season.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Falls After Weekly Losses as Traders Focus on Mideast Risk

Apr 22, 2024

Skittish Oil Market Enters an Uneasy Calm Over Middle East Risk

Apr 19, 2024

Exxon’s Market Value Tops Tesla’s as Oil Rises, EV Sales Slow

Apr 19, 2024

Oil Jumps Toward $90 After Israel Is Said to Strike Iran Targets

Apr 19, 2024

AD Ports Group signs deal with ADNOC Distribution for global distribution of marine lubricants

Apr 19, 2024

Europe Car Sales Drop in March as EV Weakness Persists

Apr 18, 2024

ADNOC to redeem exchangeable bonds in ADNOC Distribution upon maturity in June 2024

Apr 18, 2024

Oil Edges Lower as Israel Weighs Up Response to Iranian Attack

Apr 17, 2024

Oil Erases Gain as Traders Weigh Israeli Response to Iran Attack

Apr 16, 2024

Kent confirms enhanced project alliances with ExxonMobil and Repsol Norge

Apr 16, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum