China’s Reopening Boost to Commodities Prices Is Losing Power

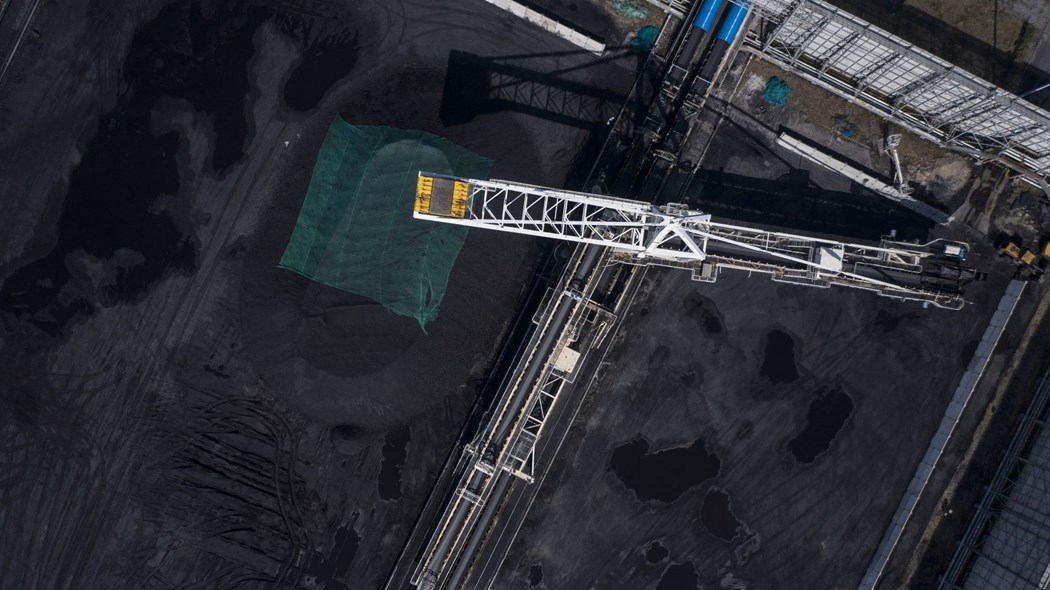

(Bloomberg) -- The China reopening trade for commodities is showing signs of flagging, as weak demand offsets speculative bets that the end of Covid Zero will reignite growth.

Although there seems little doubt that the economy will bounce back this year, questions over the timing and degree are capping prices from copper to coal and crude oil. Highlighting the uncertainty, Caixin’s report on Wednesday showed that manufacturing shrank for a sixth straight month in January, undercutting a more positive reading on factory activity from the statistics bureau the day before.

Copper futures have risen about 20% since the start of November, the month when China’s commitment to Covid Zero first began to wobble. That puts the metal at risk of a pullback if demand conditions don’t improve soon, said Jiang Hang, head of trading at Yonggang Resources Co. in Shanghai.

“We are very cautious on copper, which has priced in high expectations” as China reopens, said Jiang, citing a build-up in domestic stocks and low run-rates at fabricators. Belying the run-up in futures markets, spot and import premiums for the metal have dropped, with the premium paid at the port of Yangshan falling to its lowest since April.

Thermal coal prices are also in decline. That’s due in part to rising temperatures, but it also reflects weak industrial consumption as many firms are still to emerge from the Lunar New Year holiday, Fengkuang Coal Logistics said in a report. Even the recovery in China’s oil demand, fueled by a resurgence in travel, could fall short of expectations, according to Bloomberg Intelligence.

Clouding the picture is a dearth of top-line data for the rest of the month. China typically combines its January and February economic statistics for publication in March to smooth out the impact of the Lunar New Year, which will leave investors to pick over lesser indicators to judge the near-term trajectory for growth.

Further out, cracks are starting to appear in the nation’s demand prospects. Caterpillar Inc. warned overnight that its machinery sales in China will be softer this year, which lines up with the idea that Beijing’s efforts to revive the economy will emphasize the services sector over metals-intensive state spending on construction.

“We are relatively neutral on China’s future consumption,” Yonggang’s Jiang said of copper. “There isn’t room for massive fiscal stimulus from the government.”

The Week’s Diary

Wednesday, Feb 1:

- MMG Ltd. briefs on 4Q results, 09:00

- Caixin’s China factory PMI for January, 09:45

- CCTD’s weekly online briefing on China’s coal market, 15:00

Thursday, Feb 2:

- Nothing major scheduled

Friday, Feb 3:

- Caixin’s China services & composite PMIs for January, 09:45

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

On The Wire

- Iron Ore Near Seven-Month High After Vale Misses Output Estimate

- Housing Slump Deepens From US to China in Risk to Global Growth

- Shein Can’t Be the Model for China’s Solar Boom: David Fickling

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Erases Gain as Traders Weigh Israeli Response to Iran Attack

Apr 16, 2024

Kent confirms enhanced project alliances with ExxonMobil and Repsol Norge

Apr 16, 2024

Mexico’s Sheinbaum Plans to Spend Billions on Gas, Solar Plants

Apr 15, 2024

What’s Next for Crude Oil? Analysts Weigh In After Iran’s Attack

Apr 15, 2024

Oil Traders Weigh Risks of Iran-Israel Conflict in Tight Market

Apr 14, 2024

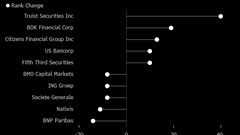

US Regional Banks Dramatically Step Up Loans to Oil and Gas

Apr 14, 2024

Oil Rises to October High as Israel Prepares for Iranian Attack

Apr 12, 2024

Gold Hits New Record, Oil Rises on Mideast Tension: Markets Wrap

Apr 12, 2024

Oil Swings Near $90 With Risk of Iran Strike on Israel in Focus

Apr 11, 2024

Oil Holds Two-Day Loss as Report Points to Rising US Inventories

Apr 10, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

Neway sees strong growth in Africa

Feb 27, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum