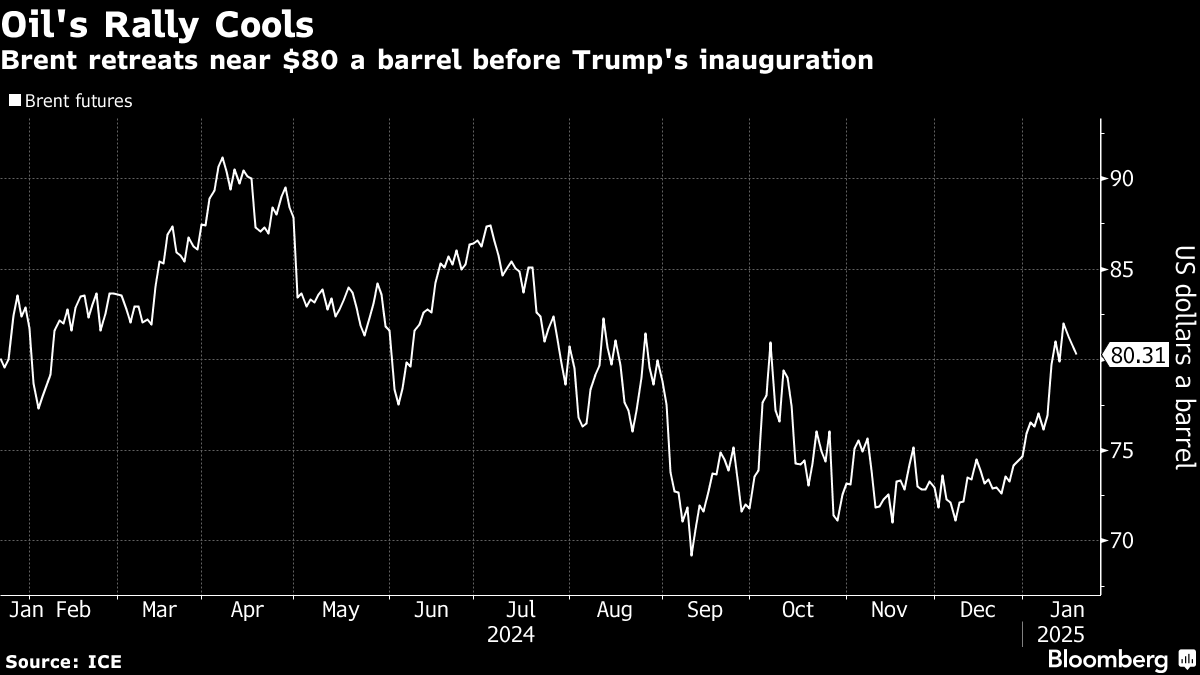

Oil Dips Toward $80 as Market Braces for Second Trump Term

(Bloomberg) -- Oil edged lower ahead of the inauguration of President-elect Donald Trump, as the market braced for a period of uncertainty and turmoil at the start of his second term in the White House.

Brent traded near $80 a barrel after falling over the past two sessions. Trump is poised to invoke emergency powers in the hours after he’s sworn in as part of his plan to unleash domestic energy production, according to people familiar with the matter.

The incoming president has also threatened hefty tariffs on trade partners including China, Canada and Mexico, and could implement sanctions on Iran.

“Trump’s inauguration speech today and any potential decrees will set the agenda for the week,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “Naturally, the oil market is focused on statements regarding sanctions on Iran, Russia, and Venezuela. Attention is also on tariffs, particularly concerning Canadian and Mexican oil.”

Crude has rallied at the start of the year, after frigid weather in the Northern Hemisphere drove higher heating demand and broader US sanctions on Russia’s oil industry left customers in Asia seeking alternative supplies. Trading volumes for Monday’s session may be lower due to a federal holiday in the US.

The additional sanctions on Russia have upended tanker markets, pushed up prices of Middle Eastern crude and led to a widening gap between Brent’s two nearest contracts, known as the prompt spread. Speculators have increased their net wagers on rising prices for the global benchmark, although there’s also been a smaller buildup of short positions.

Scott Bessent, Trump’s nominee for Treasury secretary, said last week he would support dialing up measures targeting Russia’s oil industry, which would likely mean even more disruption. The President-elect’s pick for national security adviser has previously vowed “maximum pressure” on Iran.

©2025 Bloomberg L.P.