Oil Steadies as Traders Look to OPEC Report and Inflation Data

(Bloomberg) -- Oil held a gain before the release of an OPEC market outlook, with traders looking for signs on whether supply curbs will be extended, as well as US inflation data that will shape expectations for monetary policy.

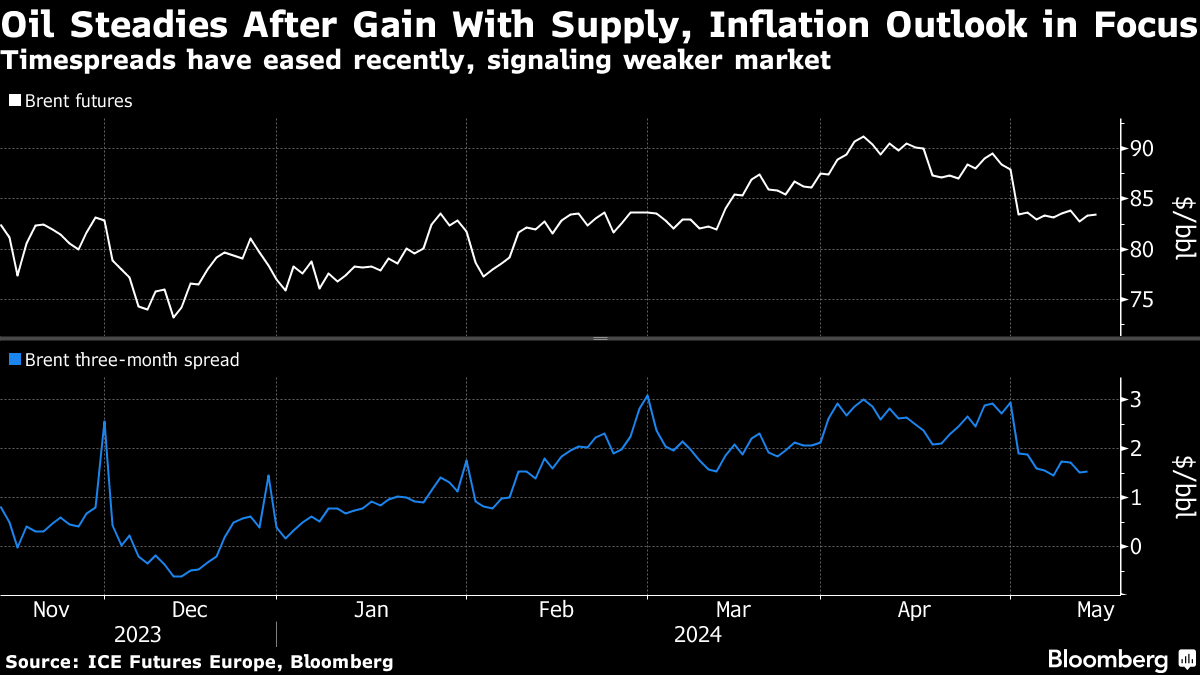

Brent traded above $83 a barrel after rising 0.7% on Monday, with West Texas Intermediate near $79. With evidence of refinery run cuts and narrowing timespreads pointing to a slightly softer market, the cartel’s monthly deep dive comes about two weeks before members meet to decide on policy.

In the US, meanwhile, producer price data later Tuesday, followed by a consumer print the following day, will yield clues on whether the Federal Reserve has the leeway to reduce interest rates later in the year, or expectations for cuts get pushed into 2025.

Crude has been on a downward trajectory since April, with the geopolitical risk premium ignited by tensions in the Middle East largely evaporating. Still, prices remain higher year-to-date as OPEC and its allies restrict flows, and the group is widely expected to extend the curbs into the second half.

“We think OPEC+ are likely to keep current production plans unchanged, thereby entrenching voluntary supply cuts,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia. Against that backdrop, and with advanced economies expected to reduce interest rates, Brent will average $80 a barrel in the third quarter, and $85 in the final three months, Dhar said.

©2024 Bloomberg L.P.