Oil’s Run of Gains Comes to Halt as Risk-Off Sentiment Flares

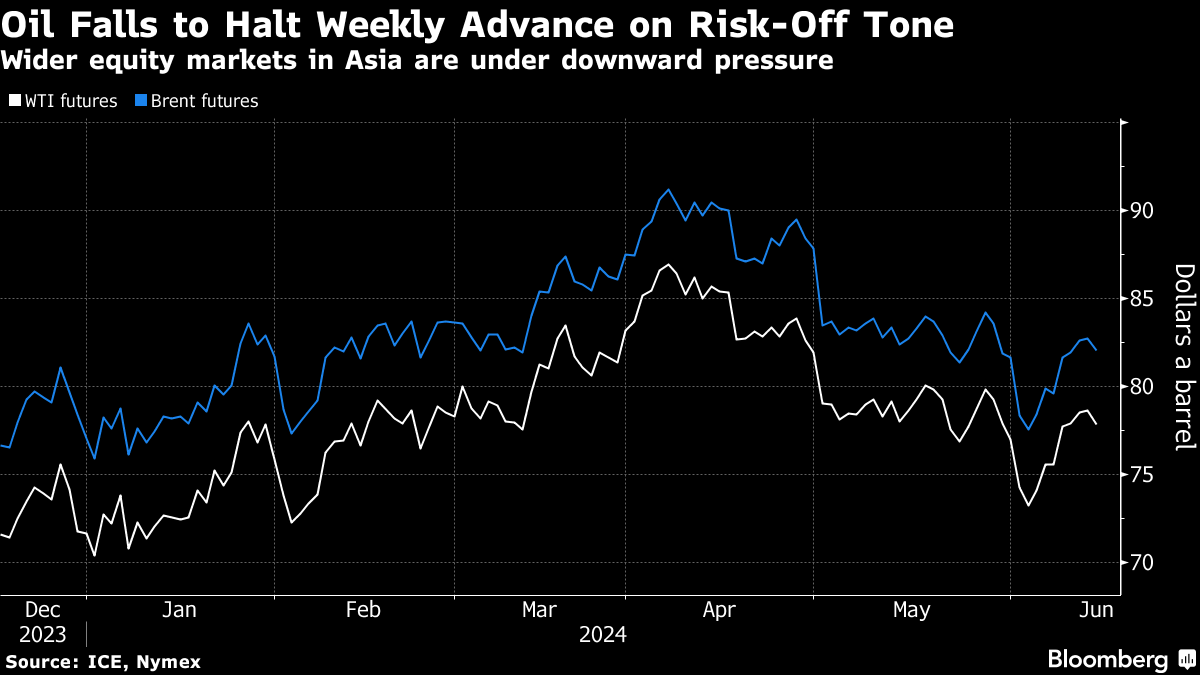

(Bloomberg) -- Oil declined, paring a weekly gain, on a risk-off tone in wider financial markets and more signs of robust global supply.

Brent dropped toward $82 a barrel, on track to snap four days of gains, while West Texas Intermediate was near $78. Stocks in the region fell, putting downward pressure on risk assets such as oil. While there have been signs of cooling US inflation, Federal Reserve officials this week penciled in only one interest-rate cut this year.

“Market participants are reassessing if they have got ahead of themselves as weaker-than-expected US economic conditions were presented overnight amid the recent ‘hawkish hold’ from the Fed,” said Yeap Jun Rong, market strategist for IG Asia Pte in Singapore.

Oil has declined since early April, in part due to concerns over demand, although attacks on ships by the Yemen-based Houthi militants have started to ramp up again, jeopardizing trade flows. More supply from the US, as well as an ongoing slowdown in Chinese refining activity, are further clouding the outlook.

Still, timespreads are holding in a bullish, backwardated structure, where later-dated contracts trade at a discount to nearer ones, indicating tight supplies. The gap between Brent’s two nearest contracts was at 40 cents a barrel in backwardation, compared with 28 cents a week ago.

The International Energy Agency this week flagged a major surplus this decade as the shift away from fossil fuels accelerates, a call that drew a rebuke from the Organization of the Petroleum Exporting Countries.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Declines After Surge as Traders Keep Focus on Middle East

US Watching Dark Fleet Ship-to-Ship Oil Transfers in Asia Waters

Aramco CEO Says He’s Bullish on China After Stimulus Roll-Out

Oil Rebounds as Israel Plans Next Iran Move After Weekend Attack

Oil Prices Show How Numb Traders Have Become to US Sanctions

US Pins Hope for Cease-Fire and More on Sinwar’s Killing

Diesel Exports From China Decline to Lowest Level Since Mid-2023

Oil Steadies as Traders Weigh Middle East Risks, China Outlook

World Set for Cheaper Energy on Shift From Oil and Gas, IEA Says