Oil Builds on Weekly Gain as Traders Bet on Summer Demand Growth

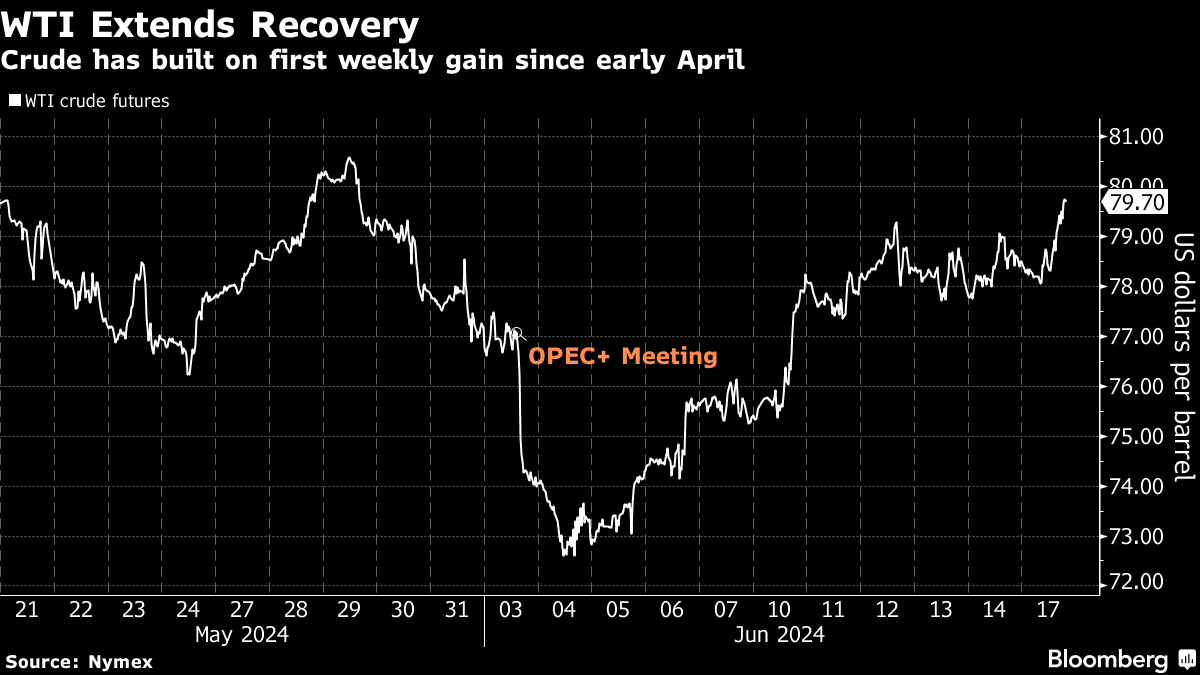

(Bloomberg) -- Oil climbed, building on its biggest weekly advance since early April and extending a short-covering rally as traders bet on summer driving season.

West Texas Intermediate traded above $79 a barrel after climbing 3.9% last week, the first weekly gain in nearly a month. The US benchmark crude rose as traders bet that demand will rise — and inventories will draw down — as the summer driving season continues. Prices also broke through their 200-day moving average.

“Oil’s resilience suggests investors are expecting the oil market to tighten as we head deeper into the US driving season,” Fawad Razaqzada, a market analyst at City Index and Forex.com, said in a note Monday.

Crude futures powered higher last week, driven in part by a major bout of short-covering, with outright bearish wagers on the global Brent benchmark falling by the most since 2020. The rally reversed a sharp slump after OPEC+ signaled the potential return of some barrels to the market later this year, which forced key members of the producing group to clarify that they can pause or reverse production changes if necessary.

Strong macroeconomic signals have also given crude a lift. US non-farm jobs have performed better than expected, and key indicators show that inflation is cooling, though the Federal Reserve is holding interest rates steady and planning for just one rate cut in 2024.

Oil had trended lower since early April on signs of robust supply, waning geopolitical risk from the Middle East as well as concerns over demand, particularly from China.

Chinese industrial output and fixed-asset investment posted slower growth, and oil refining fell to the lowest rate this year after more plants shut for maintenance. China’s oil refining — known as crude throughput — is expected to be flat or fall this year for the first time in two decades, excluding a downturn in 2022 due to Covid-19, according to most market watchers surveyed by Bloomberg.

The nation processed a record volume in 2023 as demand rebounded. Retail sales data offered some encouragement, picking up more than expected.

©2024 Bloomberg L.P.