Oil Dips After Three-Day Gain With US Stockpiles, Fed in Focus

(Bloomberg) -- Oil edged lower after a three-day advance as investors weighed an unexpected build in American crude stockpiles and the outlook for US monetary policy, which is expected to be tighter for longer.

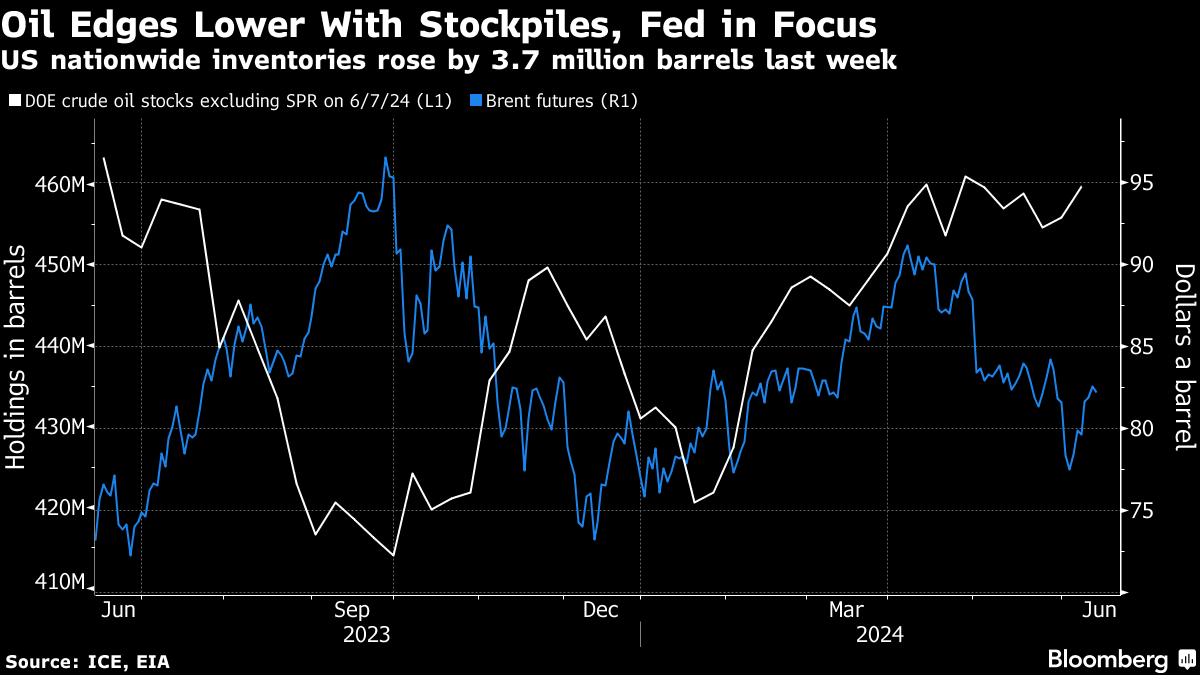

Brent dipped toward $82 a barrel after climbing almost 4% this week, while West Texas Intermediate traded near $78. US crude inventories swelled by 3.7 million barrels last week, compared with an industry report that had pointed to a draw. Government figures also signaled rising gasoline stockpiles.

US consumer price data sparked a risk-on mood across broader markets on Wednesday as inflation cooled for a second month, but the Federal Reserve has left interest rates unchanged and penciled in just one cut this year.

“With the Fed’s hawkish dot plot shift, there are some demand concerns back on the radar,” said Charu Chanana, market strategist at Saxo Capital Markets Pte. That’s adding to bearish pressures as “supplies are looking robust.”

Oil has trended lower since early April on concerns about the demand outlook and ample supply, while geopolitical tensions eased. The International Energy Agency said in a report on Wednesday that global markets face a major surplus this decade as the shift away from fossil fuels picks up pace.

A commodity carrier is taking on water after being hit by a drone near Yemen, highlighting the persistent risks shippers face sailing through the region. The vessel is called Tutor, according to people familiar, and Houthi militants claimed responsibility for the attack.

©2024 Bloomberg L.P.