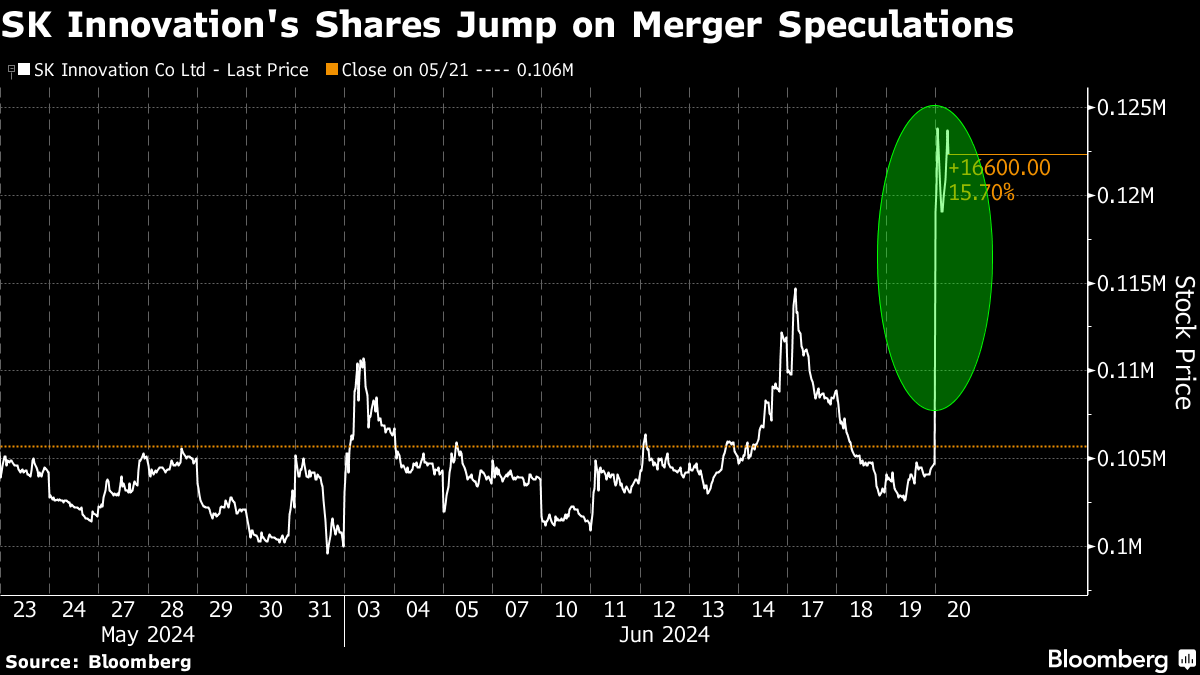

SK Innovation Shares Soar Most Since 2021 on Merger Speculation

(Bloomberg) -- Shares of SK Innovation Co. topped gains on the regional MSCI Asia Pacific Index amid speculation the South Korean energy company may merge with a private affiliate to strengthen competitiveness.

The stock rose as much as 20% Thursday, its biggest jump since January 2021, after local newspaper Chosun Ilbo reported that SK Group’s various executives will meet to approve the deal next week. SK Innovation confirmed in a statement Thursday that it is “considering various strategic plans, including mergers,” but added that no decision had been made yet.

The possible merger with SK E&S Co. - a unit that provides liquefied natural gas, renewable energy and other energy resources - may create an energy company with assets of around 106 trillion won ($76.6 billion), according to regulatory filings.

However, the merger may be opposed by retail investors of SK Inc., the holding company behind South Korea’s second-biggest conglomerate, which fell more than 6% amid concerns the deal could reduce the dividend income. SK Inc. owns a 90% stake in SK E&S, according to a May filing and a 36% interest in SK Innovation.

The majority of SK Inc.’s dividend returns comes from SK E&S, making the deal unfavorable to billionaire Chairman Chey Tae won, who owns an 18% stake in the holding company. Chey would need to pay 1.38 trillion won in property division and 2 billion won in alimony to his estranged wife, if South Korea’s Supreme Court upholds a Seoul High Court ruling.

“Why would Chey move ahead with the deal that could reduce the value of SK Inc. is puzzling,” said An Hyungjin, chief executive officer at Billionfold Asset Management Inc. “I’m perplexed.”

SK Innovation has lost over 40% of its market value in the past year through Wednesday, with S&P Global Ratings cutting its credit rating to junk in March amid a slowdown in demand for electric vehicle batteries and high capital expenditures.

Assuming there is a merger, the move is “slightly” positive for the SK Innovation stock but the impact also depends on the details of the merger deal, Cho Hyunryul, an analyst at Samsung Securities Co., said.

(Updates with background, investor’s comments)

©2024 Bloomberg L.P.